Weekly Outlook | Mixed Sentiment And Risk Off Moves Dominate

Important events this week:

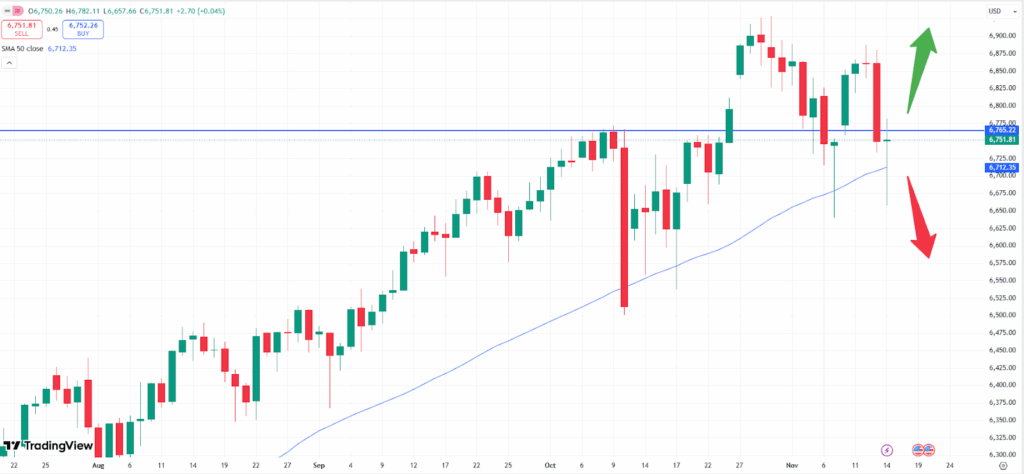

After attempting to create new all- time- highs, most stock markets started to fade moving to lower levels. With the S&P 500 turning weaker also the Nasdaq 100 technology index ran out of steam. Worries in regards to highly leveraged AI companies with huge debt continue to frighten investors. Chip manufacturer Nvidia also started to move lower, whereas the previously hyped database company Oracle also saw a sharp decline in recent trading days.

Big technology companies continue to dominate the S&P 500 index and weaker momentum might hence cause the index to move lower as well. However, the positive sentiment in the short run might remain positive as Friday’s trading cause the index to strengthen again.

The long overdue Nonfarm payrolls report will follow on Thursday and this might shed more light into the state of the US economy. Traders should be prepared for bigger swings into either direction in markets.

US Nonfarm payrolls report: The last reading from September only showed 22.000 newly created jobs in the US. Current expectations offer a wide range and with the data having been absent last month might also cause markets to move erratically.

In general, a weak reading might support the US Central Bank to act further and hence cut interest rates again at the next meeting on the 10th of December. A rate cut would in particular be positive for equities and with the end of quantitative tightening might hence boost stock markets. The Fed stated that they will start reinvesting in markets again, which will add fresh liquidity. They will stop reducing the size of their balance sheet due to rising volatility in money markets.

The S&P 500 index is in particular interesting. Based on the daily chart the index has been falling towards the 50- moving average, which can be seen in blue color. Yet, the week ended on a positive note on Friday. If the 6.700 price level will not break, fresh upside momentum might be found in particular above the 6.765 zone, where a recent resistance can be found. The data will be released on Thursday, 20th November at 14:30 CET.

US PMI data: Today we will take a look at the Dollar index. The basket of the currency index, with the majority being the EUR shows the general strength of the Dollar. The index has been falling in the first half 2025 but resumed slight upside momentum again in recent months. However, the upside remains limited as the weekly chart below shows.

Right at the horizontal trendline at 100.00 the market found a strong resistance and started to fade again. Currently, it looks like that the price of the Dollar will weaken again, which would in turn cause most other currencies like the EUR, JPY, GBP, CAD among others to potentially gear up steam again. A weaker Dollar also helps equities to rise again. On the other hand, a stronger release of the purchasing manager index n the US might cause the index to rise again. The data will be released on Friday, 21st November at 15:45 CET.