US inflation takes back seat to growing labour pains

* Wall Street post record high closes as Tesla and Micron rally

* Dollar retreats as inflation runs warm, jobless claims tick higher

* ECB holds rates steady amid mild inflation downside revisions

* Gold steadies after record-breaking rally

FX: USD eventually weakened through the day even though CPI came in a touch higher than expected. The tariff impact still seems to be playing out with costs absorbed by company profit margins. But the Fed is now more focused on the softer labour market with slowing rents and energy prices potentially seeing lower CPI through next year. Jobs were in focus too yesterday with initial jobless claims much higher than forecast. There may be one-off Texan flood factors involved here but weak hiring more broadly lines up the 25bps Fed rate cut next week. In fact, markets now price in 73bps of easing for 2025 versus 68bps pre-data. This week’s low is 97.25 with the late July low at 97.18.

EUR moved north though prices initially fell on the ECB statement. Rates were left unchanged as expected with focus on the new economic projections. These had a mild dovish bias with inflation forecasts lower. But President Lagarde later said that the disinflationary process was over, risks to the economy were more balanced than before, and the inflation outlook was well-behaved. Overall, policy remains in a ‘good place’ with the bar still relatively high for another rate cut.

GBP pushed higher near to the top of its recent range in cable just below 1.39. Concerns over longer-term UK borrowing costs have temporarily abated with the 30-year yield having pulled back from its recent multi-decade high seen at the start of the month. There is a bunch of important data ahead of the BoE meeting next week.

JPY underperformed and traded around the technically important 50-day SMA, now at 147.53. Rate hike bets are firming with expectations of a hawkish shift in tone at next week’s meeting. But this is battling with domestic political upheaval with a noted monetary and fiscal dove intending to run in next month’s LDP leadership race.

AUD led the major gainers again as it enjoys its best week since the rebound from the April Liberation Day spike lows. The 200-week SMA sits at 0.6678 with prices hitting levels last seen in November. Buoyant risk sentiment is a key driver, with the kiwi also strong this week. CAD lagged again on rising concerns about the economic headwinds facing Canada after the disappointing August jobs report.

US stocks: The S&P 500 gained 0.85% to close at 6,587, the 24th record high close of 2025. The Nasdaq rose by 0.6% to settle at 23,993, a fourth straight record closing high and a seventh straight day of gains. The latter hasn’t been seen since August last year. The Dow Jones finished at 46,108, up 1.36% as it breached 46,000 for the first time ever. All sectors were in the green except for a marginal loss of the Energy sector. Materials and Health led the gainers with Tech and Communication Services lagging. Oracle fell back 6.2% after its record-breaking surge on Wednesday. The tech company had revealed its pipeline of contracts to supply computing power to AI groups had expanded to $455bn from just $138bn three months ago. That briefly made its CEO Larry Ellison the world’s richest man. Tesla climbed 6% while Micron jumped 7.6% after Citigroup raised its price target to $175. The semiconductor index (SOX) hit an all-time high.

Asian stocks: Futures are in the green. Stocks traded mostly mixed after soft US PPI data but most awaiting CPI figures. The ASX 200 was muted as financials, consumer discretionary and healthcare lagged. The Nikkei 225 rose through 44,000 to fresh highs on tech strength, despite mixed data. The Hang Seng and Shanghai Comp were mixed with Hong Kong lower as pharma dragged, on reports the US is considering big restrictions on medicines from China.

Gold has, quite predictably, paused for breath after its strong, classic break to the upside which began at the end of August. The record high sits at $3,674 with bugs content to consolidate amid falling Treasury yields and fairly elevated geopolitical tensions.

Day Ahead – UK GDP

Growth is expected to print three-tenths lower at 0.1% in July after June’s strong upside surprise. Manufacturing and construction are both set to act as a drag on activity. That would see the Q2 reading at 0.3%, somewhat lower than the 0.7% pace from Q1 which was boosted by government consumption. Going forward, economists reckon Q3 could remain surprisingly solid with good weather and possibly the Oasis concerts helping.

There is a lot of top tier UK data next week with job numbers released on Tuesday, CPI figures on Wednesday ahead of the BoE meeting on Thursday. Markets are expecting the MPC to sit on its hands, as price cuts have been priced out in recent weeks. Sticky inflation alongside slowing growth leaves policymakers between a rock and a hard place, but their primary concern at present is elevated price pressures.

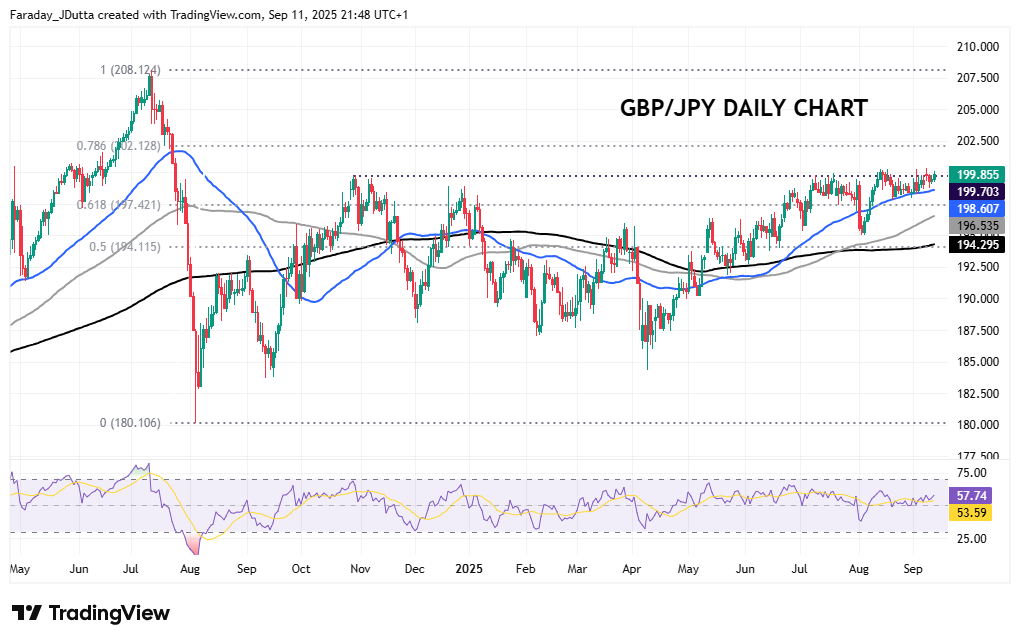

Chart of the Day – GBP/JPY building for a breakout?

This cross has both the BoE and BoJ meetings next week to contend with. As both are likely to stand pat on rates, who will be the most hawkish? The chart is signalling upside pressure with support at the 50-day SMA at 198.60 and below here at the major Fib level (61.8%) of the July to August 2024 fall at 197.42. Resistance resides at the swing high from October last year at 199.70, which capped the upside on several occassions over this summer. Momentum strategies that we use tell us that the longer prices track sideways, the bigger the breakout will be, and this is typically in line with the longer-term dominant trend. Upside targets include the minor fib (78.6%) at 202.12, ahead of the very long-term high at 208.12.