Trump says government shutdown likely

* Dollar dips as threat of US government shutdown looms

* S&P 500, Nasdaq tick up even with closure worries ahead of NFP

* Gold closes higher on soft jobs data and dollar

* Eurozone inflation set to tick up but no cause for ECB action

FX: USD dipped again after Friday and Monday’s tick down. Focus is on the government shutdown but as we have said, this very rarely has a big economic impact. There have been 20 shutdowns since the 1970s with most being short-lived. That said, a closure would delay the release of Friday’s NFP as well as other data. The JOLTs report showed job vacancies increased modestly in August when hiring dropped.

EUR moved marginally higher with a third consecutive day of gains. German state CPIs came in hotter than expected but French metrics were cooler.

GBP also ticked up for a third straight day but backed off the 50-day SMA at 1.3463. some focus was on PM Starmer’s speech at the Labour Party conference though he didn’t add much new on the fiscal side.

JPY outperformed on a third straight day of strength. Prices moved below the 200-day SMA at 148.37 and found support at the 50-day SMA at 147.76. Modest strength came from the latest BoJ minutes which signalled that the bank is moving closer to more rate hikes.

AUD led the gainers again as the RBA left rates at 3.6% as expected, but with a hawkish hold. The cautious stance reflects concern over rising headline CPI inflation which is nearing the upper bound of the bank’s 2-3% target range. CAD underperformed with the major pretty flat on the day. The 200-day SMA sits at 1.3990 with prices consolidating in a bullish pattern. As we have said before, seasonals going into the end of the year are weak for CAD.

US stocks: The S&P 500 gained 0.41% to close at 6,688. The Nasdaq moved higher by 0.28% to settle at 24,680. The Dow Jones finished at 46,398, up 0.18% while small caps underperformed with the Russell 2000 up 0.05% at 2,436. Only one sector was in the red, Utilities (-0.16%). Consumer Discretionary led the gainers (+2.25%) with Communication Services, Industrials and Financials all up over 1% on the day. There was little stock-specific news. A government shutdown looms and with economic data releases delays. After funding is restored, the BLS would announce a new release date. Thursday’s weekly jobless claims are likely not to print, but ADP should still do so.

Asian stocks: Futures are mixed. Stocks traded mixed after a solid Wall Street handover but eyes on the US government shutdown. The ASX 200 traded flat with financials lower but offset by gold miner strength, amid the hawkish RBA tone at their meeting where it left rates unchanged. The Nikkei 225 underperformed on more yen strength and losses led by energy names. The Hang Seng and Shanghai Comp were mixed as the former gave up earlier upside and the latter held onto mild gains. Chinese PMIs showed manufacturing beat expectations while services slipped.

Gold surged again to new highs at $3,871 before paring gains as Treasury yields moved off their intraday lows.

Day Ahead – Eurozone Inflation, ADP & ISM data

Consensus sees headline eurozone inflation rising two-tenths to 2.2% and core holding steady at 2.3%. Services and energy prices may give a temporary uplift to inflation. But the ECB sees underlying pressures stabilising over the medium-term. That means policy should remain ‘in a good place’ for the foreseeable future. A hotter report could further rein in expectations of one final ECB rate cut by year end and help the euro. There’s only around 2bps priced in for 2025.

US labour market figures are front and centre this week (unless we get a government shutdown as per above) with ADP private payrolls set to be released today. This data has historically been a poor predictor of NFP. But the recent downward revisions to the headline payrolls number have seen more importance attached to ADP. Consensus sees around 52k jobs added. US September ISM manufacturing activity is expected to tick up to 49.2 from 48.7. That means it still sits in contractionary sub-50 territory. Focus will be on input costs which remain elevated.

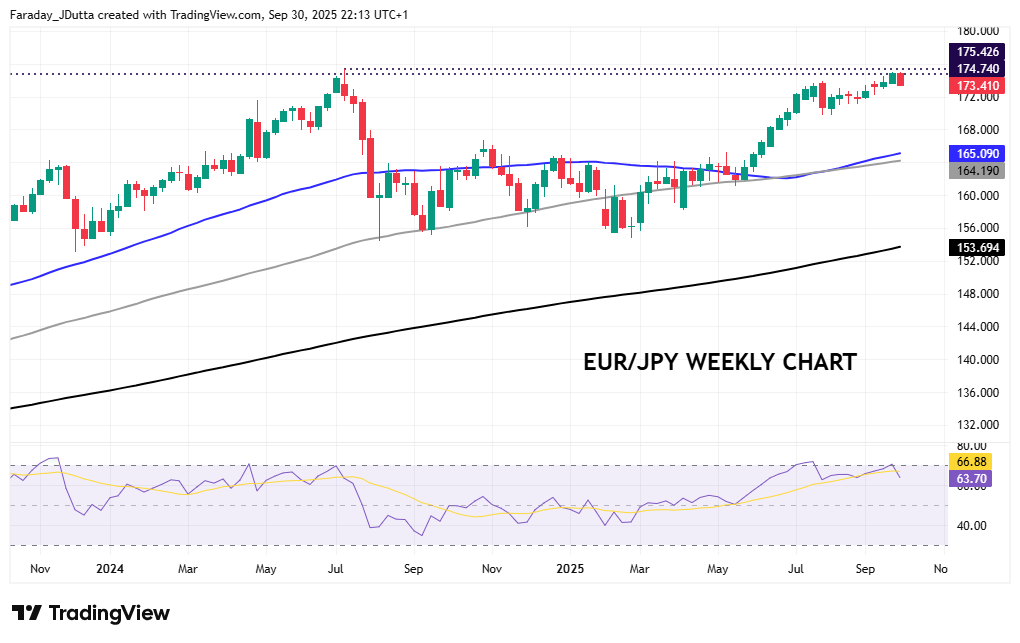

Chart of the Day – EUR/JPY backs off major resistance zone

The yen has underperformed across the board, with only CAD and NZD worse off this month. Local Japanese issues dominated with fears of Japanese politics heading towards looser monetary and fiscal conditions. The big day is 4 October though opinion polls are now siding away from the dovish Takaichi. That could give the yen a bid and see this fall. The euro has been bolstered by an ECB which is sitting on its hands amid relatively solid data. This has seen this popular pair edge up to the long-term top from July last year at 175.42. That should be fairly formidable resistance with an area that includes the high from August 1992 at 174.74.