Stocks bid, USD dips with eyes on new Fed official

* Trump raises India tariffs to 50% over Russian oil purchases

* Kevin Hasset is the current frontrunner as the next Fed Chair

* USD falls on possible dovish next FOMC official, increasing rate cuts bets

* Bank of England expected to deliver fifth rate cut in current cycle

FX: USD weakness in August continued after very recent consolidation and its plunge after last week’s quarter of a million downward revision to previous NFP data. Prices are touching its 50-day SMA at 98.24 which acted as resistance previously and so is now support. ISM services data pointed to strong weakness ahead in jobs figures while speculation about a dovish new Fed official is not helping the greenback. We are watching FOMC member speeches this week, with talk possibly of a third rate cut in 2025, though yesterday Kashkari said two were appropriate but if inflation rises due to tariffs, the Fed could pause, or even hike. Markets currently price in a September 25bps rate reduction and 62bps in 2025.

EUR topped the majors versus the greenback as it pushed higher through recent resistance at the 50-day SMA at 1.1592. There’s not been a lot of new news since the EU-US trade agreement. Reuters reports that the EU will likely have to wait a few more days for President Trump’s order to lower tariffs on EU auto imports. Retail sales showed improvement but wasn’t a big mover.

GBP was midpack among its peers with eyes on the BoE meeting. See below for more details. UK data reflected a deeper than expected contraction in the July Construction PMI, which fell to 44.3, the weakest in five years. A UK think tank reported that Chancellor Reeves has a £50bn shortfall/black hole that she will need to fill in the October budget.

JPY moved higher and the major lower, but it found support around a major Fib level just above 147. The latest domestic wage data saw labour cash earnings rise more than expected.

AUD and NZD outperformed all their peers except for the euro. The aussie is nearing its 50-day SMA at 0.6512. NZ jobs data yesterday was mixed as the unemployment rate ticked higher and wage gains outpaced consensus estimates. CAD strengthened as the major slid towards 1.37 after the big outside reversal bullish day on last week’s US jobs report. Canada jobs figures are released on Friday.

US stocks: The S&P 500 printed up 0.73% at 6,345. The Nasdaq settled higher, by 1.29% at 23,315. The Dow Jones finished up at 44,194, adding 0.19%. Heavyweight stocks led the gains with Consumer Discretionary heavily outperforming, while Health Care lagged. Tech saw gains too despite a weak AMD report after hours on Tuesday. Apple closed up over 5% on reports it will remain largely unaffected by the tariffs targeting India. The company also said it would make a domestic manufacturing pledge of $100mn. Amazon jumped 4% after it had its self-driving unit Zoox vehicles certified for demo use, closing a probe. McDonald’s rose 3% after revenue and sales topped estimates on more affordable meal bundles. Markets are also eyeing up more Fed rate cuts with Kevin Hassett, a well-known dove the favourite as the next Fed Chair.

Asian stocks: Futures are green. APAC equities were again mixed after a muted handover Stateside amid Trump comments and soft ISM services figures. The ASX200 gained on mining, resources and materials strength. The Nikkei 225 moved higher through the session on weak labour cost data and heavy industry stock gains. The Shanghai Comp and Hang Seng were mixed with few domestic drivers.

Gold printed lower but an inside day. Prices look to be consolidating below $3,400 with stronger resistance at the June and July highs and the downward trendline from the record top at $3,500. The 50-day SMA sits at $3,344.

Day Ahead – Bank of England meeting

Markets expect the MPC to cut the base rate by 25bps to 4%. The vote is predicted to be split again, potentially with another three-way divide. The labour market is loosening and GDP shrank in April and May, but inflation remains sticky with the headline at 3.6% and services at 4.7%. The bank’s “gradual and careful” mantra is expected to remain, which has seen rate cuts occur only every quarter when the Monetary Policy report (MPR) is released.

Policy remains restrictive at 4.25% relative to neutral rate estimates. There’s around 43bps of rate cuts priced in for 2025 so the focus will be on whether rate setters hint at a quicker pace of cuts. That would upset GBP which has suffered over the past 30 days and is the worst major versus the dollar.

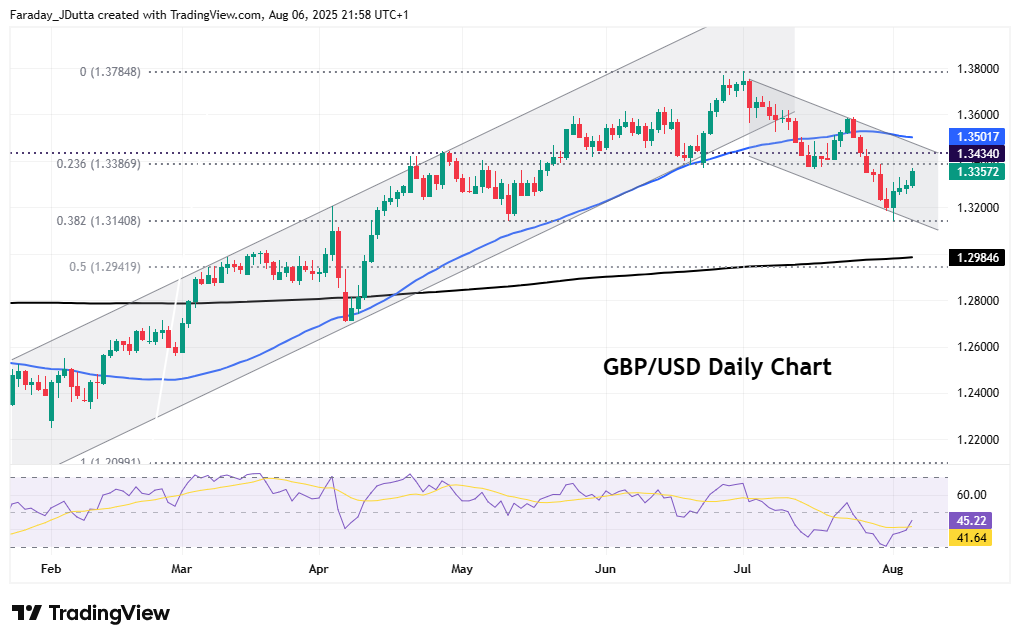

Chart of the Day – GBP/USD trying to rebound

As above, cable has been the big underperformer in recent weeks, on dollar strength and traders eyeing up the worsening domestic finances and Autumn fiscal black holes. Prices touched a major Fib retracement level (38.2%) of this year’s rally at 1.3140. We’ve seen four straight days if buying, driven by the big dollar sell-off and bullish outside reversal day after last Friday’s NFP data. Resitance above is a zone aorund 1.3386/1.3434. The 50-day SMA is above here at 1.3501.