Stock bid goes on amid big week of risk events

* S&P 500 and Nasdaq post fresh record high ahead of FOMC meeting

* Google’s parent, Alphabet, becomes the 4th $3trn company by market cap

* Dollar hits July lows as traders await big risk events

* Gold powers to another new high, above inflation adjusted peak set in 1980

FX: USD kicked off a huge week in defensive mode as it broadly weakened against its major peers. Five of the G10 central banks are meeting, and three of them are expected to cut. The highlight is the Fed with a strong consensus looking for a 25bps cut, and then two further 25bps moves in October and December. The market currently prices around 67bps of the 75bps in expected cuts this year. Could the new dot plot reveal a more hawkish stance with fewer, quarterly cuts? Last week’s low is 97.25 with the late July low at 97.18 a target for bears if the Fed is more cautious about the labour market.

EUR was a mild underperformer but rose versus the dollar for a third straight day as it edged above the 50-day SMA at 1.1659. Last Thursday’s neutral ECB meeting contrasts with this week’s expected dovish Fed. German ZEW investor sentiment is released today and likely to show a decline. The euro took the French debt downgrade in its stride, even though the instability of the political system – with three different governments since the snap election just over a year ago – weakens the capacity to deliver much needed fiscal consolidation.

GBP marginally outperformed, printing a fresh cycle high at 1.3620 on the positive risk tone and ahead of numerous UK data releases and Thursday’s BoE meeting. There were several announcements over the weekend about inward investment by US firms ahead of President Trump’s state visit to the UK.

JPY underperformed again as it continued to trade around its 50-day SMA at 147.52. Thursday’s BoJ meeting won’t yield a rate hike, but potentially (hawkish) guidance will be important into a possible October rate move and also the LDP election on 4 October. Japan CPI is also released on Friday.

AUD made more new cycle highs on positive risk sentiment. Poor China activity data hastened calls for more stimulus from the Chinese government. CAD strengthened in line with its major peers versus USD with lots of domestic data and the BoC on this week’s calendar. The central bank should deliver a 25bps rate cut which would put the overnight rate below the current midpoint of the BoC’s neutral estimate of 2.25-3.25%.

US stocks: The S&P 500 gained 0.47% to close at 6,615, the 25th record high close of 2025. The benchmark index is up seven of the past nine trading days and up 32.8% since the April Liberation Day low. The Nasdaq rose by 0.84% to settle at 24,294, a third straight record closing high and a ninth straight day of gains. The latter hasn’t been seen since November 2023. The Dow Jones finished at 45,883, up 0.11%. Sectors were mixed with the heavy-cap sectors (Communication, Consumer Discretionary and Tech) outperforming, while Consumer Staples and Healthcare lagged. Breadth was negative with around 200 gainers to 300 losers. Big Tech again led the gainers though Nvidia finished very modestly in the red due to China antitrust investigations, even as it pared some of its losses. Google joined the $3trn market cap club while Tesla rallied on the Musk share purchases.

Asian stocks: Futures are in the green. Stocks traded mixed after disappointing China data and eyes on this week’s big risk events. The ASX 200 lagged amid weakness in mining, financials and healthcare. The Nikkei 225 was closed due to a holiday in Japan. The Hang Seng and Shanghai Comp were modestly higher on tech strength as focus turned to China-US talks about TikTok.

Gold jumped higher after bullish consolidation. Falling yields and the dollar boosted bugs to fresh record highs at $3,685.

Day Ahead – UK Jobs, US Retail Sales

A UK data-heavy week kicks off with the latest labour market report. Thursday’s very likely unchanged rate decision at the BoE meeting will not be moved by these figures (or tomorrow’s CPI) but will have a bearing on the November MPC decision, along with the next mid-October employment figures. The jobless rate is likely to stay at 4.7% but with some upside risks. Payrolls and vacancies will be watched after recent weakness. Markets only price in around 8bps of BoE rate cuts this year and a total of 40bps by next summer.

Headline US retail sales are forecast to rise 0.3%, down from the prior 0.5%, due to a modest pullback in car sales in August. The ex-autos figure is seen at 0.3%, unchanged from the July print. Muted consumer sentiment due to slowing income growth and rising prices may weigh. There may have been cutbacks on goods where tariffs have notably increased prices.

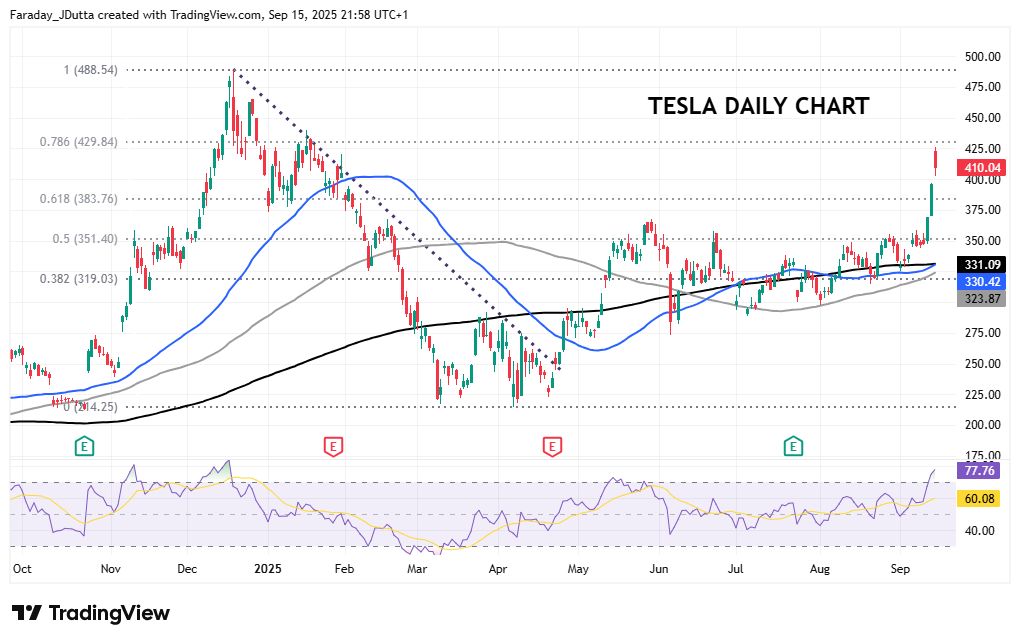

Chart of the Day – Tesla soars into overbought territory

Tesla has surged over the last few trading days, to its highest close since late January on a combination of positive news events. CEO Elon Musk disclosed he had bought 2.6mn shares worth about $1bn, taking his total holding to roughly 413mn. This marks the first time since Febraury 2020 that Musk has bought stock. Last week saw news about new energy storage units and megablocks, which are intended to cut costs and speed up installation for utility projects. Revenue from energy generation and storage rose 18% y/y, offsetting softer vehicle sales. Self-driving in Nevada getting the ok from authorities also helped, amid the recent $1tn compensation plan ofr Musk unveiled the previous week.

The EV-maker added close to 13% last week and is up eight days in the last nine. Going into this week, the stock was still down around 2% on the year, but this has now been erased with CEO Musk’s firm up 10% y-t-d. The stock is now naturally very overbought after the strong rally, with the 78.6% Fib retracement level of the December to April drop at $429.88. The record high sits at $488.54. Support sits at the major Fib level (61.8%) at $383.76 and then around $350, which is the midpoint of the move and has capped upside previously on several occasions.