Markets choppy on earnings and US-China trade tensions

* TACO trade back in spotlight as US stocks reverse earlier losses

* Gold steadies above $4,100 as Powell strikes neutral-dovish tone

* Dollar softer versus safe haven JPY and CHF, gains against AUD and NZD

* Japan to convene extraordinary Diet session on October 21st

FX: USD remain under a long-term low from 2023 at 99.57 and a minor Fib level at 99.61. Prices were choppy with a bid slowly ebbing away from the time the US session kicked off. There was a lot of noise between the US and China over trade, which should be expected into the November 1st deadline for Trump’s 100% tariffs. Elsewhere, Fed Chair Powell sparked a slight dovish market move in Treasuries after noting they may be approaching the end of the balance sheet contract in the coming months. The 10-year yield dropped just below 4% before moving higher.

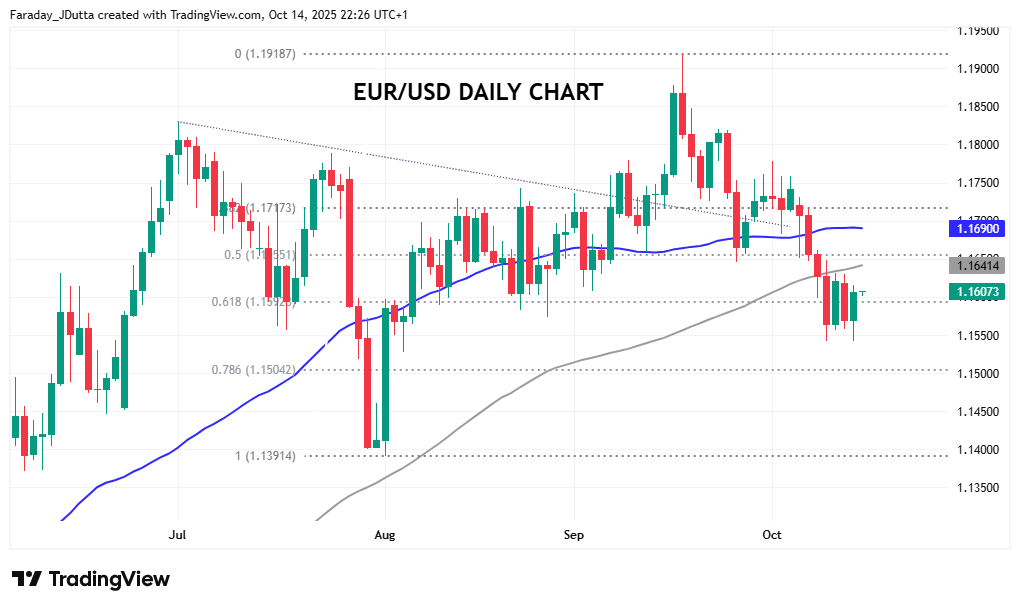

EUR stayed above last week’s low at 1.1542 but remains below the 100-day SMA at 1.1641 and a major Fib level of the August to September move at 1.1592. French:German bond spreads narrowed, and EUR/CHF stuck above recent lows, for now. The French political situation remains uncertain. The ECB’s Lagarde offered little new on policy, reiterating it is generally in a good place, while ECB official Villeroy said the next move is more likely to be a cut than a hike.

GBP underperformed though clawed back losses after spiking down to 1.3248. We got a mildly dovish UK jobs report with softer wage growth and headline job gains. Chances of a rate cut by February next year marginally increased.

JPY choppy price action this week continued as it reverted to type and strengthened on safe haven flows amid the trade-related risk aversion. This was a return to historically established relationships around the risk-off mood, in contrast to the domestic political scene that has been dominating recently. Markets are digesting the possibility of shifting coalitions in Japan’s parliament with a vote now expected next week.

AUD underperformed on mixed risk sentiment but retraced over half of its losses having posted a three-week low at 0.6440. The 100-day SMA sits above at 0.6531. CAD was mid-pack in the majors with prices pulling back after the intraday spike at 1.4080. Stronger than expected Canadian jobs data last Friday gave the loonie little protection against the broader advance of the USD.

US stocks: The S&P 500 lost 0.16% to close at 6,644. The Nasdaq moved lower by 0.69% to settle at 24,579. The Dow Jones finished at 46,270, up 0.44% on the day. Tech was the big underperformer and Consumer Discretionary lagged, while Consumer Staples and Industrials outperformed with eight out of 11 sectors in the green. On earnings, JP Morgan and Goldman Sachs were the laggards, while Wells Fargo and Citigroup strengthened on top and bottom-line beats, and Blackrock’s assets under management hit a record $13.46trn, as attention turns to Morgan Stanley and Bank of America today. More US-China trade tensions surfaced with stocks initially in the red, before paring gains through the session and then closing negative after President Trump threatened to end business with China on cooking oil. Walmart rose 5% after it partnered with OpenAI to create AI-first shopping experiences with instant checkout via ChatGPT. Industrial stocks helped the Dow close positive with Caterpillar jumping after JP Morgan raised it price target.

Asian stocks: Futures are mixed. Stocks traded mixed on the rebound Stateside while Japan lagged on reopening. The ASX 200 struggled with mining and materials gains competed with losses in financial and consumer-related sectors. The Nikkei 225 returned from holiday and fell sharply as the Japanese ruling coalition split caused more domestic political uncertainty, along with ongoing US-China trade frictions. The Hang Seng and Shanghai Comp were lower on more trade tensions between China and the US.

Gold hit fresh record highs at $4,179 but backed off those levels with bullion deeply overbought. Strong inflows into ETFs, escalating US-China trade tensions and traders’ confidence in Fed rate cuts have all helped the 55% year-to-date rally. Silver also extended its rally with prices hitting all-time highs above $53, fuelled by a historic short squeeze in London.

Day Ahead – No US CPI

The Bureau of Labor Statistics (BLS) in the US published a statement on Monday saying that the September CPI will be released on 24 October. The announcement also repeated that no other releases will be rescheduled or produced until the resumption of regular government services. This implies that the CPI figures will be released during the FOMC blackout ahead of the October Fed meeting.

There currently seems to be no end in sight for the US government shutdown and the distinct lack of US data. Betting markets are unmoved in attaching around a 63% probability that the shutdown extends into November. Instead, the focus is on central bankers and their communication. Fed Chair Powell noted the available data suggests the current economy is where it was in September, but data shows tariffs are pushing up price pressures.

For stocks, a major Wall Street bank strategist said that stretched valuations (S&P forward P/E ~22x), overcrowded bullish positioning, and seasonal weakness have set up an “overdue” correction, which could be amplified by weak global dollar liquidity and potential earnings downgrades.

Chart of the Day – EUR/USD trying to find support

French political chaos continues to loom over the euro, though the spread between French and German government bonds narrowed quite sharply yesterday. A no-confidence vote and then government collapse this week looks less likely now after PM Lecornu announced a suspension of the 2023 pension reform until the presidential elections in 2027. But the broader sentiment is dominating in an environment of renewed trade tensions, offering EUR some relative support as an alternate haven. The major is trading around a major short-term Fib level (61.8%) of the August to September move at 1.1592. The 100-day SMA sits above at 1.1641. The next minor retracement level below is 1.1504.