Equities rally into Thanksgiving as GBP survives Budget Day

* Stocks buoyed by rate cut expectations, up four days in a row

* Dollar soft again on pressured by potentially Hassett at the Fed helm

* RBNZ cut rates by 25bps, could be the last in the cycle

* GBP thrives on UK Budget as investors welcome more headroom

FX: USD was lower again for a fourth straight day but comes after mild consolidation near recent highs. The Dollar Index moved down through the 200-day SMA 99.77. Prices have hit the upward trendline from the late September low. The 10-year yield stuck around the psychologically important 4% level. December Fed rate cut bets are now locked in after the big move over the weekend. The Fed’s Williams kicked off the move and we now have news that Kevin Hassett is the frontrunner to take up the Fed Chair next year. He is a well known dove and advocates aggressive rate cuts, prioritizing growth of inflation control. That is music to President Trump’s ears, though Hassett has previously stressed the importance of a fully independent central bank. Data was mixed with better initial jobless claims but disappointing Chicago PMI.

EUR was midpack with much focus on the Russia-Ukraine peace talks. This is a rate differential play so some optimism could smooth the recovery in the euro above 1.17. President Trump thinks that they are getting very close to a deal, while making progress and Ukraine is happy. Trump also said Europe will be largely involved in security guarantees. The 50-day SMA sits above at 1.1626.

GBP was well bid in what many called a relief rally after the UK Budget. We called it a ‘rumour/fact type event’ as Gilt yields edged lower through the day in a sign that bond markets were relatively unmoved by the Chancellor’s fiscal plans. For sterling, the Budget was not especially contractionary in the short term and didn’t cause a major reprice of the BoE terminal rate. Higher headroom was taken positively initially though austerity is seemingly pushed out in what some called just ‘kicking the can’ down the road. Cable bulls will aim for the 200-day SMA at 1.3303. If the double bottom reversal pattern plays out, the target is closer to 1.34.

JPY underperformed as the yen weakened even on overnight hawkish-leaning BoJ sources overnight. The bank is reportedly preparing markets for a possible hike as soon as December, although one of the sources noted that the decision between hiking in December or January remained a close call. PM Takaichi said the stimulus package isn’t reckless spending and they will watch FX for any speculative moves. The major moved above 156 into today’s data.

US stocks: The S&P 500 added 0.65%, closing at 6,810. The benchmark index is up 4 straight days and is enjoying the biggest 4-day % win streak of 4.2% since late April. It is now just 1.15 off record highs at 6,890. The Nasdaq moved higher by 0.87% to finish at 25,237. The Dow settled higher by 0.67% at 47,427. Tech was one of the clear outperformers with Utilities leading the gainers, but Communication Services lagged with AI names trading higher after recent pressure, although Alphabet gave up some of its recent rally, weighing on the sector as it neared the $4 trillion market cap mark. Oracle jumped 4% after an investment bank reiterated its buy rating. Deere & Co tumbled 5.7% after it issued downbeat guidance below expectations.

Asian stocks: Futures are mixed. Stocks were mostly higher again on the Wall Street rally. The ASX 200 was led higher by mining and materials with tech and telecoms lagging. The Nikkei 225 jumped with Softbank leading the way, though there were reports the BoJ is preparing markets for a possible hike as soon as December. The Hang Seng and Shanghai Composite underperformed their regional peers with mixed earnings from Alibaba and NIO. The former’s CEO did push back against AI bubble chat and confirmed a pick up in investment.

Gold moved over 1% higher in the early part of the day before giving up gains into the US session. Prices tapped a minor fib level (23.6%) of the September break higher at $4,173 which acted as resistance. A few big banks upped their 2026 price forecasts citing more central bank buying.

Day Ahead – Tokyo CPI

This data is the forerunner to nationwide inflation and is forecast to rise 2.7% y/y in November. Solid wage gains and the weaker yen likely added upward pressure. There’s only around a 16% chance of a December BoJ rate hike. Otherwise, recent nationwide CPI inflation excluding fresh food increased a bit to 3.0%, confirming the uptick from the prior Tokyo data. The weak yen will continue to push for high import prices, which adds to speculation that the Bank of Japan will soon hike rates again.

New PM Takaichi recently approved a supplementary budget worth JPY21.3 trillion, representing the largest stimulus package since the pandemic. The runup to this has weighed heavy on the yen and pushed longer-dated Japanese Government bond yields higher.

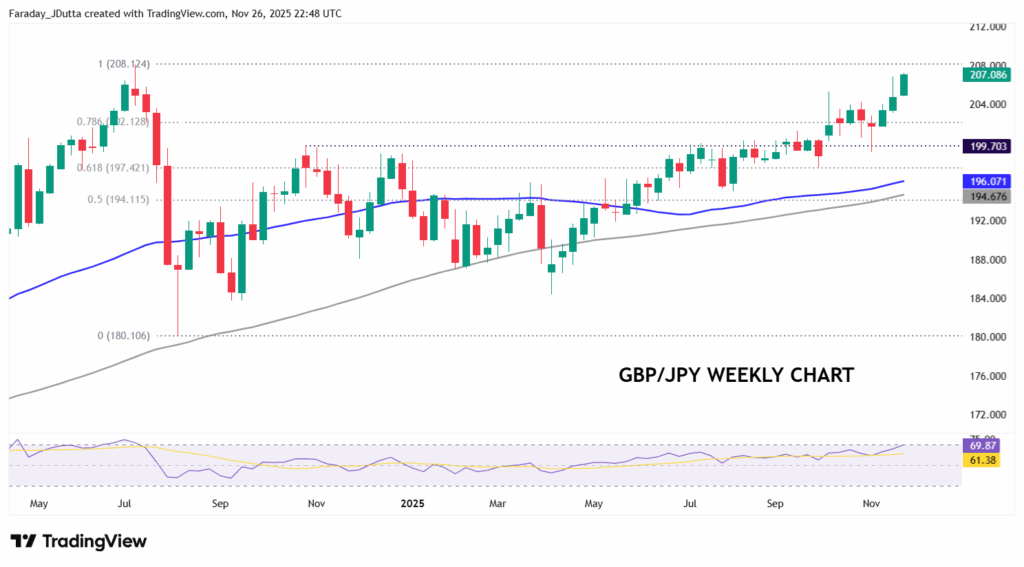

Chart of the Day – GBP/JPY upside breakout

This very popular cross has just broken to new highs last seen in July 2024. After trading around 200 for some time, prices pushed higher in early October above 205 before trading sideways and then falling back below the psychological 200 marker. November has seen strong bullish momentum this month with the pair pushing above the October top at 205.31. Bulls will target that July 2024 high at 208.12. A minor Fib level sits at 202.12.