With inflation easing and major central banks including the Fed and ECB signalling an end to aggressive rate hikes, 2025 is shaping up to be a pivotal year for fixed income investors. As volatility in equity markets continues and global economic growth remains patchy, bonds are back in focus—offering both stability and potential returns.

In fact, a recent report by BNP Paribas indicates the bond market is now larger than the global stock market in June 2025, at an estimated USD140 trillion versus USD115 trillion [1].

Whether you’re a seasoned investor or just beginning to explore fixed income, understanding the key types of bonds available today is essential. Each bond type has unique characteristics and risk profiles. Understanding these differences can help readers make more informed decisions.

In this guide, we’ll dive into the 10 most important types of bonds you should know in 2025:

- Government bonds

- Treasury bonds

- Bond ETFs (exchange-traded funds)

- Green bonds

- Sovereign bonds

- Convertible bonds

- Corporate bonds

- Mortgage bonds

- Municipal bonds

- Agency bonds

Keep reading to learn how different bond types behave in various market conditions and how traders may gain exposure via contracts for difference (CFDs).

Note: The bond types below are shared for educational purposes. Vantage offers CFDs on selected government bond futures only, not direct investments in the underlying bonds.

Key Points

- Rising bond yields, especially in the US and Japan, highlight how economic policy impacts bond performance.

- Keeping an eye on macro shifts—like Trump’s tax plan or inflation in Japan—can help inform smarter bond trading decisions.

- From government and corporate bonds to green bonds and ETFs, understanding them can help you navigate volatile markets more confidently.

What Are Bonds?

Bonds are essentially loans you make to governments, municipalities, or companies as an investor.

When you buy a bond, the issuer promises to pay you regular fixed interest (called the coupon) and return the original loan (the principal) at a set future date (aka the maturity). It’s a straightforward way for investors to earn steady income while helping issuers raise capital.

Recent market discussions show how sensitive bonds are to current events. Yields on ultra-long US Treasuries jumped sharply to 5% while Japanese 40-year bonds increased to 3.4% [1] after concerns over the US fiscal cut and Trump’s proposed “Big Beautiful Bill”.

When yields rise, bond prices fall—directly impacting returns if you sell before maturity. Understanding how bonds behave in different market conditions offers valuable insight into global economic trends, central bank decisions, and how your broader investment portfolio might be affected.

In this article, we share the 10 must-know bond types to look out for in 2025.

Related Article: A Beginner’s Guide to Bonds: How and Where to Buy and More

1. Government Bonds

Governments around the world issue bonds as debt securities to help raise funds for financing their budgetary needs, whether it’s for infrastructure development, public welfare programs, or debt management.

In return for this loan, the government promises to pay bondholders periodic interest payments, often referred to as coupon payments. These payment frequencies can vary depending on the bond’s terms but are usually made semi-annually. These bonds are typically considered low-risk since they are backed by the full faith and credit of the issuing government.

At the end of the bond’s term or maturity date, the bondholder will receive its principal value. Due to their secure nature, government bonds often have lower yields (2%) compared to corporate bonds [2]. However, they are also favoured by conservative investors for their stability and predictability.

2. Treasury Bonds

The US Department of the Treasury issues various debt instruments to finance the government’s expenditures. Among these, Treasury bonds (T-bonds) are the most widely known.

They come in three categories based on their maturity periods [3]:

- T-Bill (Treasury Bills): Maturity period of 1 year or less

- T-Note (Treasury Notes): Maturity period of 2 to 10 years

- T-Bond (Treasury Bonds): Maturity period of 20 or 30 years

Treasury bonds are pivotal in helping the US government fund various endeavours, from infrastructure projects to social welfare programs and national debt management. During economic uncertainties and volatile markets, many traders seek refuge in T-bonds’ reliability and safety.

It’s worth noting that T-bills operate differently from T-notes and T-bonds. While the latter two offer periodic interest to holders, T-bills are unique. T-bills are sold at a price lower than their face value, and upon maturity, they’re redeemed for their full-face value. This difference between the purchase price and the face value serves as the investor’s potential return.

As a whole, treasury bonds pay a fixed rate of interest, which can generate steady returns. Additionally, these bonds are typically seen as low-risk, given that they are backed by the US government, which has a lower perceived default risk.

Related Article: Treasury Notes vs Treasury Bonds: What are the Differences, and How to Trade Them?

3. Bond ETFs (Exchange-Traded Funds)

Bond ETFs (exchange-traded funds) let you invest in a diversified basket of bonds—whether government, corporate, or emerging-market—through a single equities-style trade. They’re typically passively managed, aiming to replicate a bond index, which makes them cost-effective and highly accessible.

In 2025, bond ETFs have attracted $132 billion in inflows [4], reflecting growing demand for flexible fixed income exposure amid market volatility and shifting interest rate expectations. These ETFs offer liquidity, real-time pricing, and diversification—key advantages over holding individual bonds directly.

Some popular options include:

- iShares Core US Aggregate Bond ETF (AGG): Tracks a broad mix of US investment-grade bonds

- Vanguard Total Bond Market ETF (BND): Covers the entire taxable US bond market

- iShares JP Morgan USD Emerging Markets Bond ETF (EMB): Focuses on sovereign debt from emerging markets

Bond ETFs are a way to gain exposure to a diversified group of bonds. While not directly offered on the Vantage platform, some brokers may offer CFDs referencing similar indices.

Related Article: Bond Exchange Traded Funds (ETFs): What Are They and Why Trade Them

4. Green Bonds

Green bonds—sometimes referred to as sustainable bonds or climate bonds although they are not synonymous—are special-purpose bonds where the proceeds fund environmentally positive projects like clean energy, sustainable infrastructure, or climate resilience. These are issued by governments, corporations, or supranational organisations and function just like traditional bonds—except the funds are earmarked for green initiatives.

The green bond market recently surpassed $1 trillion in outstanding issuance in 2024, driven by continued strong appetite from ESG-focused regions—especially in Asia Pacific and Latin America [5]. Green bonds are designed to fund environmentally focused projects and may appeal to market participants with sustainability goals, though returns and risks can vary.

5. Sovereign Bonds

Sovereign bonds are debt instruments issued by a national government to secure funds for various purposes, including:

- Financing government initiatives

- Settling previous debts

- Covering other fiscal requirements

These bonds can either be denominated in the government’s currency or a foreign currency. They represent an agreement by the government to pay periodic interest and return the principal on a specified date.

Developed nations with stable economies often have their bonds classified as virtually risk-free. In contrast, emerging markets might offer higher yields to compensate for increased risks.

For example, the JPMorgan Emerging Market Bond Index (EMBI) Global, a common benchmark for emerging market’s hard currency sovereign bonds, is 7.81%. This is significantly higher than the 10-year US Treasury bond’s yield, which is currently around 4.39% as of June 2025 [6, 7].

Before purchasing sovereign bonds, traders should be aware of their bond rating. This rating reflects the issuer’s financial health and capacity to fulfil the bond’s principal and interest obligations.

6. Convertible Bonds

Convertible bonds are a unique type of financial instrument that blends the best of both worlds: Traditional bonds and company shares.

When you invest in a convertible bond, you’re essentially buying a regular bond—with the added option to convert it into a predetermined number of the issuing company’s shares. The conversion rate and other terms are defined at issuance and are often determined in the bond indenture.

This built-in flexibility is what makes convertible bonds so appealing.

If the company’s stock price takes off, the bondholder can choose to convert their bonds into shares and potentially make a return from the upside. But if the stock underperforms, investors can still earn fixed interest payments and get the full principal back when the bond matures—just like with any standard bond.

Real- World Example: Airbnb’s Convertible Bonds

In March 2021, Airbnb issued $2 billion in convertible senior notes due 2026 with some stipulated conditions.

- Each convertible bond has a $1,000 face value, 0% interest, and matures in 2026, with a conversion ratio of 3.4645 Airbnb shares.

- If an investor holds the bond to maturity without converting it to shares, they will receive $1,000 in principal back as the bond carries no interest.

However, if Airbnb’s stock starts trading above $288.64 per share (the implied conversion price—which was 60% higher than its stock price of $180.40 at the time), then converting might become more attractive.

- If the stock trades at $320, then 3.4645 shares would be worth $1,108.64, which exceeds the bond’s face value.

- The investor could choose to convert the bond into stock and receive 3.4645 shares—or continue holding if they believe prices could rise higher.

Note: In this Airbnb’s example, conversion isn’t allowed freely until 15 December 2025. Before that, investors can only convert if certain conditions are met, such as the stock trading at or above 130% of the conversion price for a specific period [8].

7. Corporate Bonds

Corporate bonds are issued by companies to raise capital. They are usually used for:

- Company expansion

- Undertaking new projects

- Debt financing

An investor who buys these bonds is essentially loaning money to the company in return for periodic interest payments and the bond’s face value upon maturity.

Corporate bonds often offer higher yields than government bonds but come with greater risk. This higher risk arises because corporations are relatively more likely to default on their debt compared to governments. The bond’s rating, provided by agencies like Moody’s or Standard & Poor’s, plays a vital role in helping investors gauge the default risk and make informed decisions.

Higher-rated corporate bonds typically carry lower credit risk, though they also offer lower yields. Risk preferences vary depending on the trader’s strategy and objectives. However, higher-yielding corporate bonds generally come with an increased risk of default or credit downgrades, and may not suit all traders.

8. Mortgage Bonds

Mortgage bonds are a type of asset-backed security tied to real estate. When people take out mortgages from lending institutions, these mortgages can be bundled together and sold as investments to the broader market as mortgage bonds.

The primary appeal of mortgage bonds lies in their dual layer of protection:

- Firstly, each bond is backed by actual real estate—so if a borrower defaults, the lender can recover some value by selling the seized property.

- Secondly, because you’re investing in a pool of mortgages, this means that even if one or two mortgages in the pool default, the others can still generate cash flow, possibly softening your losses.

That said, there are still risks to consider.

Interest rate changes can influence how often homeowners refinance. When refinancing rates spike, bonds may get paid off early, which can reduce your overall returns. So while mortgage bonds offer some safety features, it’s important to stay mindful of how economic shifts could affect them.

9. Municipal Bonds

Municipal bonds are issued by local governments, such as cities or state governments. The funds raised are often used for public projects like road infrastructure, new schools, or hospitals, which ultimately contribute to community development and enhancing the quality of life for residents.

Municipal bonds may offer tax benefits in some jurisdictions, even though they also carry credit and liquidity risks. In many places, the interest from these bonds is exempt from government taxation. The potential tax benefits of municipal bonds have historically made them attractive to some investors, although they are not available through Vantage’s trading platform.

10. Agency Bonds

Agency bonds are issued by government-affiliated organisations in the US or their equivalents globally, such as the:

- Federal National Mortgage Association (FNMA), otherwise known as Fannie Mae

- Federal Home Loan Mortgage Corporation (FHLMC), also called Freddie Mac

- Federal Home Loan Bank (FHLB)

- Government National Mortgage Association (GNMA), or referred to as Ginnie Mae

These entities raise funds to support sectors like housing, education, or agriculture.

While agency bonds aren’t always fully backed by the government (unless issued by entities like Ginnie Mae), they’re still considered relatively low-risk investments due to their close ties to public institutions. They typically offer slightly higher yields than US Treasury bonds, making them attractive to conservative investors seeking a balance between safety and return.

3 Smart Bond Trading Strategies for Today’s Market

There are multiple ways to gain exposure to bond markets. The following three methods vary in terms of risk, accessibility, and instrument type:

- Direct subscription at issuance

- Trading on the secondary market

- Trading bond CFDs (contracts for difference)

Each strategy comes with its own benefits, risks, and timing considerations—whether you’re aiming for steady income, capital preservation, or opportunistic gains based on interest rate movements.

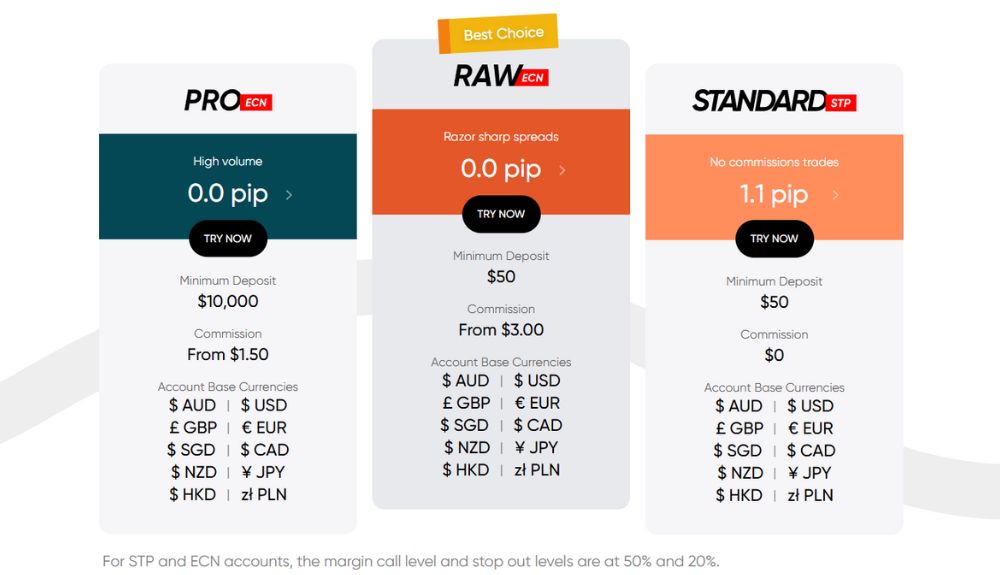

Note: Vantage offers traders and investors access to bond CFDs only, not direct bonds or ETFs.

1. Direct Subscription

Retail investors who qualify can buy bonds directly from issuers like government agencies or private companies.

For instance, in the US, federal bonds are issued by the Department of the Treasury through auctions. These bonds are typically offered at face value and don’t include brokerage fees, making them a cost-efficient option for long-term, low-risk investors.

Some other countries offer similar direct issuance programmes. In Singapore, for example, investors can subscribe to Singapore Savings Bonds (SSBs) directly via their bank accounts.

2. Secondary Market

While many government and corporate bonds are initially reserved for institutional investors like hedge funds and pensions, they can be traded on the secondary market after issuance. This presents an opportunity for retail investors to buy or sell such bonds.

Retail investors can access these bonds through online brokerages that list available fixed income products. Keep in mind that purchasing a bond on the secondary market might involve paying more or less than its face value—depending on prevailing interest rates, credit ratings, and demand—which can affect your yield. Also, brokerages often apply sale charges, commissions, or fees, so it’s important to account for these costs when calculating potential returns.

Just like stocks, bonds bought on the secondary market can be sold before maturity. Selling at a price higher than what you paid results in a capital gain, while selling at a lower price results in a capital loss.

Alternatively, you may choose to hold the bond until maturity to receive the full face value along with any coupon payments accrued during the holding period. This is ideal for those seeking predictable income and reduced reinvestment risk.

3. Bond CFDs

Bond CFDs allow traders and investors to speculate on the price movements of government or corporate bonds without actually owning the underlying security. By entering a contract with a broker like Vantage to exchange the difference in the bond’s price between the time the position is open and closed allows for potential gains or losses.

There are several advantages for short- to medium-term traders to consider this bond trading strategy in today’s markets:

- Leverage: A smaller upfront deposit is needed to open a larger position, which amplifies both positive and negative returns.

- Two-Way Opportunity: Bond CFDs can be used to take advantage of both rising and falling bond prices, offering more flexibility than traditional bond investing.

- Quick Market Access: Many retail trading platforms (like Vantage) offer bond CFDs on benchmark instruments like US Treasury notes, German Bunds, and UK Gilts, making it easier to respond to macroeconomic events, interest rate decisions, or inflation data.

However, CFDs are complex instruments that carry a higher level of risk. Because they are typically traded on margin, losses can exceed the initial deposit. Additionally, bond CFDs don’t pay interest (coupon) directly and further adjustments or swap charges may incur depending on the position and broker, which could potentially erode gains—or worsen losses—over time.

How to Trade Bonds

Bond trading can be a valuable way to diversify your portfolio and manage risk, but it requires a solid understanding of market mechanics. Whether you’re gaining exposure to bond markets through direct purchase or via CFDs, here are some general steps to consider:

1. Build a Trading Plan

Before you make any trades, define your investment goals, risk tolerance, time horizon, and preferred instruments. Are you looking for income through coupon payments, capital appreciation, or a hedge against stock market volatility?

A well-defined plan helps you stay disciplined and avoid emotional decisions during market fluctuations.

2. Research the Bond Market

Get familiar with how different types of bonds work—government, corporate, municipal, or mortgage-backed—and how they react to changes in interest rates, inflation, and credit risk.

For example, in 2025, rising yields on ultra-long US Treasuries are signalling investor concerns about the US fiscal deficit and inflation [9]. Understanding these dynamics will help you time your entries and exits more effectively.

3. Open a Trading Account

To access bond markets, you’ll need a brokerage account that supports bond trading. Make sure the selected platform offers transparent pricing, low spreads, and access to the instruments you want to trade—a good example would be Vantage.

Vantage offers access to bond markets via CFDs on select government bond futures. Do note that direct bond purchases or ETF trades are not available on the Vantage platform.

4. Open a Long/Short Position of Your Instrument

If you believe bond prices will rise (typically when interest rates are expected to fall), you might go long. If you expect prices to fall (for instance, during rising rate environments), you might consider shorting via instruments like bond CFDs or inverse bond ETFs.

Remember, bond prices and yields move in opposite directions, so staying updated on central bank policy and economic indicators is critical.

Related Article: How to Short Bonds – A Guide

5. Close Your Trade

Once your trade has hit your target profit level or stop-loss threshold, it’s time to exit. Closing the position locks in your gain or loss.

For bond ETFs or CFDs, this is usually as simple as hitting a ‘sell’ button. For direct bond holdings, you can sell on the secondary market or hold to maturity to receive full principal repayment and any accrued interest.

Vantage Bond CFDs

Now that you’ve discovered the different types of bonds, consider opening a live account today with Vantage and explore bond trading via CFDs

The bonds available on Vantage include:

- US 10 YR T-Note Futures Decimalised (TY)

- UK Long Gilt Futures (FLG)

- Euro – Bund Futures (FGBL)

With Vantage’s bond CFDs, you’re just a few clicks away to potentially capitalise on both rising and falling market opportunities.

References

- “Investment Strategy Focus June 2025 – BNP Paribas”. https://wealthmanagement.bnpparibas/en/insights/market-strategy/investment-strategy-focus-june-2025.html. Accessed on 20 June 2025.

- “How Do Corporate Bonds Differ From Government Bonds? – Forbes”. https://www.forbes.com/sites/investor-hub/article/how-do-corporate-bonds-differ-from-government-bonds/?sh=3d6a8e5930b7. Accessed on 20 September 2023.

- “Government Bond: What It Is, Types, Pros and Cons – Investopedia”. https://www.investopedia.com/terms/g/government-bond.asp. Accessed on 10 August 2023.

- “Bond market opportunities meet ETF innovation – BlackRock”. https://www.blackrock.com/us/financial-professionals/insights/innovation-meets-opportunity-with-bond-etfs. Accessed on 20 June 2025.

- “Sustainable bonds hit $1tn in 2024; 2025 repeat seen – BNP Paribas”. https://www.bnpparibas-am.com/en-fi/professional-investor/forward-thinking/sustainable-bonds-hit-1tn-in-2024-2025-repeat-seen/. Accessed on 20 June 2025.

- “The BEAT Monthly Global Market and Asset Allocation Guide – Morgan Stanley”. https://www.morganstanley.com/im/publication/insights/articles/article_thebeatjun2025.pdf. Accessed on 20 June 2025.

- “U.S. 10 Year Treasury Note – MarketWatch”. https://www.marketwatch.com/investing/bond/tmubmusd10y?countrycode=bx. Accessed on 20 June 2025.

- “Airbnb, Inc. Prices $2 Billion Convertible Senior Notes Offering – Airbnb”. https://investors.airbnb.com/press-releases/news-details/2021/Airbnb-Inc.-Prices-2-Billion-Convertible-Senior-Notes-Offering/default.aspx. Accessed on 3 July 2025.

- “The rise in long-term US Treasury yields – Brookings”. https://www.brookings.edu/articles/the-rise-in-long-term-us-treasury-yields/. Accessed on 23 June 2025.