Across empires, economic cycles, and modern markets, gold has long stood as a universal symbol of wealth, stability, and enduring value, becoming a cornerstone for those seeking to preserve purchasing power and protect against inflation.

For many investors today, however, gold is not just a commodity—it’s a popular safe-haven asset. Its unique qualities make the precious metal a common component in portfolio diversification and long-term wealth preservation.

Understanding the characteristics of gold can help investors make informed decisions about different ways to gain exposure in the markets.

Why Is Gold Valuable?

Gold’s value extends far beyond its shine and as a piece of fancy jewellery.

Firstly, gold possesses intrinsic value due to its industrial importance and rarity. Thanks to its corrosion resistance and conductivity, gold plays crucial roles in key sectors such as electronics, aerospace, and medical technology. However, mining new reserves is increasingly difficult and expensive, which cements its position as a finite natural resource with intrinsic value.

Within the financial system, gold has been historically used as a medium of exchange, with gold coins serving as currency as far back as 6,000 years ago. When societies evolved to paper money, gold was used as backing for banknotes under the Gold Standard, ensuring that each note represented a tangible store of value1.

Even after the world shifted to fiat currencies, gold has remained a cornerstone of financial stability. Central banks continue to hold substantial gold reserves as a safeguard against inflation and currency fluctuations, reinforcing its status as a global reserve asset.

This financial resilience remains visible today.

In 2025, gold prices once again reached record highs, driven by expectations of U.S. Federal Reserve rate cuts and renewed US-China trade tensions2. Historically, such macroeconomic headwinds have strengthened gold’s appeal as a defensive asset, reinforcing its role as a long-term store of value when confidence in fiat currencies wavers.

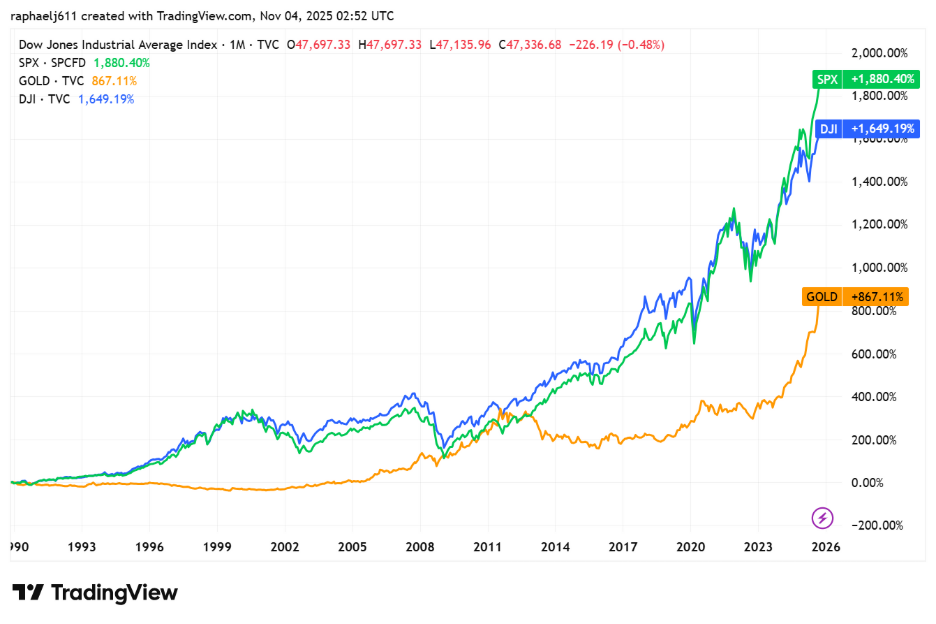

It’s not always a bed of roses, however. Over longer timeframes, gold tends to underperform equities during strong bull markets.

As shown in the chart below, over the past 30 years, the S&P 500 & Dow Jones (blue and green lines respectively) have delivered higher cumulative returns than gold (in orange)—driven by sustained economic expansion and corporate earnings growth through the 1990s and 2010s.

Chart 1: DJIA, S&P and Gold Price over the past 30 years. Sourced from TradingView (https://www.tradingview.com/x/UQZRVNqX/)

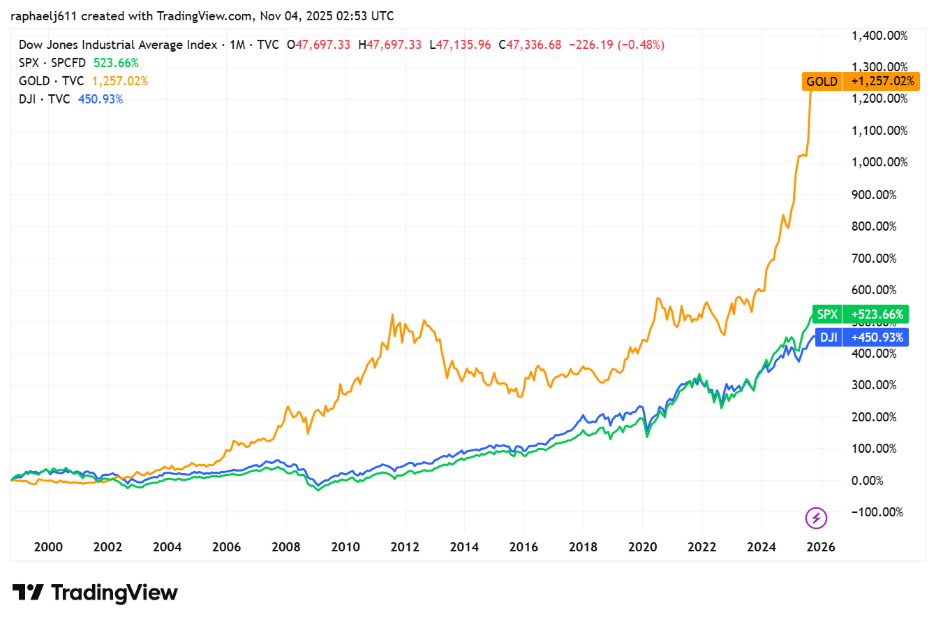

That said, the picture changes when the timeframe shifts.

Starting from 2000 when gold prices were near multi-decade lows, the precious metal has outperformed major stock indices, reflecting its traditional role as a safe haven during periods of market uncertainty. As seen below, it outshone the S&P 500 and Dow Jones during the 2001 tech bubble burst, the 2008 financial crisis, and the 2020 COVID-19 pandemic.

Chart 2: DJIA, S&P, and Gold Price over the past 20 years. Sourced from TradingView (https://www.tradingview.com/x/aJ1Zh5nh/ )

Think of gold as the anchor that steadies the ship when markets turn rough.

Many investors consider this stability an important characteristic of gold. While gold doesn’t generate income like stocks or bonds, it is often viewed as a store of value and a potential hedge during periods of market or currency volatility, helping diversify exposure to higher-risk assets.

Why Do Investors Like Gold, Especially in 2025?

While gold’s appeal has evolved over time, its role in portfolios remains distinctive. Investors are drawn to the precious metal for its liquidity, diversification benefits, perceived store-of-value qualities, and its potential performance during certain market conditions.

Liquidity

Gold is one of the most liquid assets in the world. It can typically be traded quickly through exchanges, banks, and authorised dealers, often within short timeframes. This high level of market accessibility gives investors flexibility when adjusting portfolio allocations or managing liquidity needs.

Diversification

Gold’s price movements often have a low or negative correlation with traditional risk assets such as equities. As such, it may help smooth portfolio performance over time, particularly during market stress.

Including gold as part of a broader mix of assets is often viewed as a way to diversify and potentially reduce exposure to single-market risks.

Store of Value

Gold is often perceived as a long-term store of value.

Unlike fiat currencies that can lose value through inflation, gold has maintained purchasing power over extended periods. Its enduring role as a tangible asset and global medium of exchange has made it a popular choice in both developed and emerging markets.

Returns

While gold is not designed to outperform growth assets, it has historically delivered periods of strong performance during times of high inflation, economic uncertainty, or low real interest rates.

Over the past two decades, for example, gold prices have risen substantially, reinforcing its relevance as part of a diversified portfolio for the modern investor.

How to Invest in Gold: Explore These 5 Ways

There are many ways to gain exposure to gold, depending on your investment goals, experience, and preferred level of involvement. From holding physical bullion to trading contracts for difference (CFDs), each approach carries different costs, risks, and liquidity considerations.

1. Physical Gold (Bullion and Jewellery)

Owning physical gold provides direct exposure to the precious metal itself. Bullion bars range from small, fractional sizes to 400-ounce institutional bars, while widely recognised coins—such as the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand—offer standardised purity and global liquidity.

Jewellery can also carry intrinsic value, though design mark-ups and lower purity may reduce investment efficiency compared with bullion. It may, however, carry personal or aesthetic appeal.

Always verify purity (measured in karats or fineness) and buy from accredited dealers to reduce counterparty and authentic risks.

2. Gold CFDs

For investors who prefer a more active approach, contracts for difference (CFDs) offer a way to gain exposure to gold price movements without owning the underlying asset. Through CFD brokers such as Vantage, traders can go long or short based on XAU/USD depending on their market outlook, offering flexibility in both rising and falling markets.

Unlike traditional investing, CFDs are designed for short-term speculation rather than long-term wealth preservation. Due to leverage, CFDs amplify both potential gains and losses. As such, they are typically suited to experienced traders who understand margin requirements, market volatility, and risk management.

For readers interested in active trading strategies, see our guide on “How to Trade Gold”.

3. Gold IRA

A gold IRA (individual retirement account) allows investors in certain jurisdictions to hold physical gold or gold-backed assets within a retirement portfolio. This structure can offer diversification benefits and, in some cases, tax advantages depending on local regulations.

Always review your jurisdiction’s rules, contribution limits, and custodian requirements before opening a gold IRA to ensure compliance with applicable laws.

4. Gold Futures

Gold futures are standardised exchange-traded contracts to buy or sell gold at a specified price on a future date. They are popular among institutional and professional investors seeking hedging or speculative purposes.

Given that futures are leveraged instruments, even small price movements can result in significant gains or losses. Options on gold futures also offer additional strategies for those seeking limited risk—generally capped at the premium paid—but they also require experience and understanding of derivatives markets.

5. Gold ETFs and Mining Stocks

Exchange-traded funds (ETFs), such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), offer investors convenient, low-cost access to gold price exposure without the need to store physical metal. Each share typically represents fractional interest in gold holdings and can be traded on the stock market throughout the day.

Gold mining equities provide another way to gain indirect exposure, as their performance is often influenced by both gold prices and company-specific factors such as production costs, management, and geopolitical conditions. However, mining stocks generally carry higher volatility and business risks than physical gold or ETFs.

Investors should review each company’s financial strength, reserve base, and operational efficiency before considering gold mining shares as part of a diversified portfolio.

5 Factors to Consider Before Investing in Gold

Before allocating capital to gold, it’s worth understanding the factors that influence its performance, cost, and suitability within a broader portfolio. From market trends to storage logistics, these considerations can help investors make informed, risk-aware decisions.

1. Market Conditions & Interest Rates

Gold’s performance is often shaped by broader macroeconomic factors. To illustrate, the precious metal tends to perform well when real interest rates are low, inflation expectations rise, or the US dollar weakens.

Central bank policies, global growth trends, and geopolitical developments can also influence investor sentiment towards gold. While gold is generally perceived as a safe-haven asset, its price can still fluctuate significantly depending on market conditions.

2. Storage & Insurance

Physical gold requires secure storage, whether at home in a safe, in a bank deposit box, or through a professional vaulting service. Each option carries different implications for cost, convenience, and security.

Allocated storage (where specific bars or coins are registered in your name) offers direct ownership of identifiable assets, while unallocated storage pools investors’ holdings and may carry counterparty risk. Investors should also consider the cost of insurance, which varies by provider and location.

3. Taxes & Capital Gains

Gold investments may be subject to taxation, depending on the jurisdiction and asset type. Physical gold, ETFs, and mining equities can each have different tax treatments. Investors should review local regulations regarding capital gains, sales taxes, and retirement account eligibility.

It’s recommended to seek professional tax advice before investing in gold.

4. Investment Horizon & Goals

Gold is generally used as a long-term portfolio diversifier rather than a short-term trading instrument. It may help balance risk during periods of inflation or market stress and can serve as a potential hedge against currency depreciation.

Before investing, align your gold exposure with your broader portfolio strategy, time horizon, and risk tolerance.

5. Potential Returns vs. Risks

While many investors use gold for portfolio stability, it does not generate income or dividends like equities or bonds—except in cases where investors hold derivatives or structured products linked to gold that may specify a distribution under defined conditions.

Investors should weigh the potential benefits of diversification and capital preservation against the opportunity cost of holding a non-yielding asset, particularly in environments of rising interest rates or strong equity performance.

Gold vs. Other Investment Options

| Asset Class | Volatility | Income Yield | Inflation Hedge | Liquidity | Typical Use / Characteristics |

| Gold | Low to Medium | None (unless held through mining stocks, gold-lending ETFs, or certain gold-linked structured products) | Historically strong | High | Often used for diversification and defensive purposes |

| Stocks | High | Dividends | Moderate | High | Typically associated with growth and income potential |

| Cryptocurrency | Very High | None | Weak | Variable | Highly volatile; used for speculative exposure |

| Real Estate | Medium | Rental Income | Moderate | Low to Moderate | May serve as a long-term physical asset or income source |

Gold is often viewed as a defensive asset that can help balance a portfolio during periods of market stress. Rather than competing with higher-growth investments, it typically serves as a complement within a diversified strategy.

How Much Gold Should You Have in Your Portfolio?

There is no universal rule when it comes to how much gold an investor should hold. The appropriate allocation depends on factors such as investment objectives, risk tolerance, time horizon, and overall portfolio composition.

Many financial analysts and portfolio strategists suggest allocating around 2% to 10% of a diversified portfolio to gold or other precious metals may help manage risks related to inflation, currency depreciation, and market volatility³.

Reflecting a more bullish stance, Jeffrey Gundlach, founder and CEO of DoubleLine Capital, remarked that a 25% allocation to gold is “not excessive” in the context of the US dollar weakness and shifting global currency dynamics4. However, this reflects one professional viewpoint and is not a recommendation.

For most individuals, maintaining moderate exposure to gold can provide diversification benefits and potential defensive characteristics, while allowing room for assets with stronger long-term growth potential.

The Pros and Cons of Investing in Gold

| Pros | Cons |

| High Liquidity Gold can typically be bought or sold quickly across global markets, offering flexibility and access to cash when needed. | Limited or No Income Generation Physical gold and most gold-backed ETFs do not pay interest or dividends. Some gold-related instruments, such as mining stocks, gold-lending ETFs, or structured products, may offer income or coupon features, but these depend on product design and market performance. |

| Potential Hedge Against Inflation Over long periods, gold has historically helped preserve purchasing power during episodes of rising inflation or currency weakness, although results vary across timeframes. | Can Underperform During Bull Markets When investor confidence is strong and equities rally, gold’s defensive characteristics may lead to comparatively lower returns. |

| Low Correlation With Stocks Gold prices often move differently from equity markets, which can help reduce overall portfolio volatility when used as part of a diversified investment strategy. | Storage and Insurance Costs Holding physical gold involves ongoing expenses for safekeeping and insurance, which can erode net returns over time. |

| Tangible, Globally Recognised Asset Valued and traded worldwide, gold is a physical asset that can provide a sense of security and diversification across regions and market cycles. | Price Volatility in the Short Term Gold prices can fluctuate in the short term due to changing interest rate expectations, currency movements, and geopolitical developments. |

Is Now a Good Time to Invest in Gold?

Gold’s outlook for 2025 appears broadly constructive, supported by a mix of shifting monetary policy, ongoing geopolitical uncertainty, and steady demand from both retail and institutional investors.

The US Federal Reserve has signalled a more accommodative stance, with potential rate cuts expected over the coming year5. Lower interest rates tend to reduce real yields, which can make non-income-generating assets like physical gold relatively more appealing.

Historically, periods of monetary easing have often coincided with stronger gold performance as investors rebalanced away from lower-yielding bonds and into alternative stores of value.

Geopolitical tensions and trade frictions—particularly involving major economies such as the US and China—continue to drive safe-haven demand. Simultaneously, central banks, especially in emerging markets, have been increasing their gold holdings6.

While short-term volatility remains likely, the medium- to long-term environment remains supportive for maintaining measured exposure to gold. For many investors, gold serves as a potential hedge against economic uncertainty rather than a vehicle for speculative gains.

For those seeking to preserve purchasing power and manage downside risk in an unsettled global landscape, gold may serve as one component within a diversified portfolio, depending on investor objectives and risk considerations. For timely insights into market trends and more, visit Vantage Academy’s Market News & Analysis.

Example: How Gold Investment Works

Imagine an investor allocated $1,000 in gold in 2015, when prices averaged around $1,150 per ounce. A decade later, gold trades above $2,400 per ounce, roughly doubling the nominal value of that investment7.

This illustrates how gold has historically acted as a potential store of value during a period marked by economic uncertainty, including the COVID-19 pandemic and ongoing trade tensions.

However, gold’s performance has not always been linear. Between 2012 and 2015, for example, gold prices fell by nearly 40% as the US dollar strengthened and expectations of higher interest rates reduced the precious metal’s appeal8. The Federal Reserve’s decision in 2014 to end its post-2008 stimulus programme also contributed to weaker sentiment towards gold9.

Chart 3: Gold Price dipped during the 2012 to 2015 period. Sourced from TradingView (https://www.tradingview.com/x/935nfmeH/)

These fluctuations highlight the importance of viewing gold as a long-term porfolio diversifier, not a tool for quick profits. Over time, gold has often shown a tendency to offset declines in risk assets and may benefit patient investors who use it to balance portfolio risk rather than pursue rapid gains.

3 Key Risks Every Gold Investor Should Know

Like any asset class, gold carries certain risks that investors should consider before allocating capital. Understanding these factors can help position gold appropriately within a diversified investment strategy.

1. Price Volatility

Gold prices fluctuate in response to macroeconomic conditions such as interest rate expectations, inflation trends, and investor sentiment. Periods of uncertainty or currency weakness can boost demand and trigger sharp rallies10. However, there are exceptions, such as in 2022 when gold rose despite higher policy rates and climbing real yields, supported by strong central-bank purchases and safe-haven flows11.

2. No Yield or Passive Income

Unlike stocks or bonds, physical gold and most gold-backed ETFs do not produce income, such as dividends or interest payments. Returns depend primarily on price movements. As such, during periods of strong equity performance or elevated bond yields, the opportunity cost of holding non-yielding assets like gold can increase.

Some gold-related instruments—such as mining stocks or structured products—may generate income, but these carry additional risks and depend on market conditions and issuer performance.

3. Storage and Insurance Costs

Owning physical gold—whether in coins or bars—requires secure storage and insurance. Professional vaulting or allocated storage can cost around 0.5% annually12, which may erode overall returns over time. For convenience, some investors prefer ETFs or other gold-backed securities, which remove the need for physical safekeeping but introduce market and counterparty risks.

Balancing gold with income-generating assets such as bonds or dividend-paying equities can help mitigate these drawbacks and allow gold to serve its potential purpose as a diversifier and defensive component within a broader portfolio.

Why Gold Remains a Frontier Worth Exploring

Gold’s enduring appeal lies in its ability to remain relevant across generations of investors. While currencies and asset classes evolve over time, gold continues to hold significance as a globally recognised store of value and a potential safe-haven asset during times of uncertainty.

Investors don’t need to view gold as a replacement for growth assets but rather as a complement that can enhance diversification and resilience. By incorporating gold thoughtfully within a balanced portfolio, investors may be better positioned to navigate periods of market stress and preserve long-term purchasing power.

Interested in gaining exposure to gold? Open a live account with Vantage today to explore gold CFDs (XAU/USD) and access global markets with flexible position sizing.