Wall Street up as dollar dips on expected policy easing

* Stocks gain on Fed rate cut expectations, offsetting Microsoft slip

* Dollar retreats on labour market weakness and possible new Fed head

* Oil prices rise amid lingering geopolitical tension, gold edges higher

* Treasury Secretary Bessent says Fed rate cuts needed, China good on soybeans

FX: USD broke down as it suffered its ninth straight day of losses. The Index moved below the 50-day SMA at 99.11 and the mid-November lows. The 100-day SMA sits at 98.57. The yield curve was a little steeper too, which was all in response to the increasing probability (85% from <40% last week) of Kevin Hassett being the next Fed Chair. He is seen as dovish leaning and growth supporting, and most closely aligned to President Trump. This is a key theme, at least into next week’s FOMC meeting and rate cut. ADP disappointed (-32k vs 10k expected) but ISM Services beat estimates.

EUR moved higher for an eight straight day hitting 6-week highs but was mid-pack among its peers. Divergent central bank policy is in focus with a steadfast/modestly hawkish ECB contrasting with the possibly new dovish Fed Chair. It will be interesting to see how dovish he will or can actually be, given the nature of the FOMC voting process. Bulls are aiming above 1.17.

GBP led the majors as cable jumped over 1% and above the 200-day SMA at 1.3318. It was a textbook near-term breakout from bullish consolidation and follows the double bottom pattern we had highlighted last week ahead of the Budget. There was no obvious driver with short covering potentially going on post-last week’s Budget. The 100-day SMA is at 1.3366.

JPY benefitted from dollar weakness as the major dipped closer to Monday’s low and a minor long-term Fib level. The outlook for relative central bank policy remains supportive and yield spreads are narrowing to fresh multi-year lows at levels last seen in 2022. Domestic rate expectations were little changed with markets pricing 20bps of rate hikes for the December meeting.

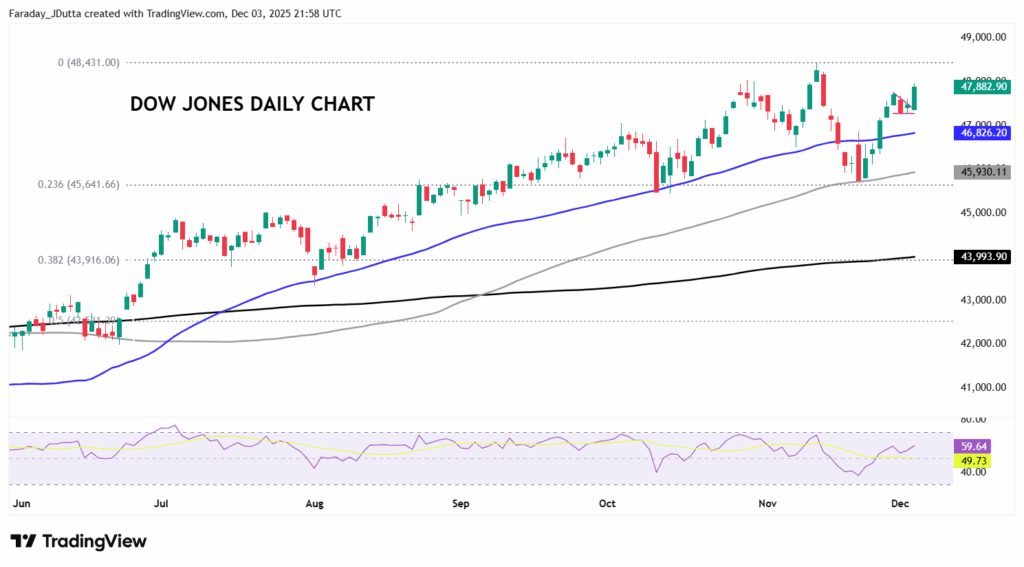

US stocks: The S&P 500 added 0.30%, closing at 6,850. The Nasdaq moved higher by 0.20% to finish at 25,607. The Dow settled higher by 0.86% at 47,883. As we said yesterday, the broad-based S&P 500 and the Dow have both been consolidating in bullish fashion, with the latter breaking to the upside as predicted. The record high in the S&P 500 is just above 6,900 and the Dow at 48,431. Media reports said Microsoft was lowering AI software quotas as multiple sales teams failed to hit quotas for AI product sales last year. The stock closed down 2.5% even though it denied the story. Equities moved higher throughout the US session after starting in the red. The majority of sectors were green, led by Energy and Financials, while Tech and Utilities closed red. Netflix dived nearly 5% as reports emerged of a cash bid for Warner Bros. Discovery which may not boost subscriber growth. Salesforce raised its annual forecasts as AI software adoption picks up steam. The stock was up close to 5% after hours. Snowflake beat revenue estimates and signed a $200mn AI deal with anthropic but the stock was off by over 8.5% after the close.

Asian stocks: Futures are mixed. APAC stocks were mixed too, with the region only partially gaining the positive Stateside momentum where tech and crypto rebounded. The ASX 200 traded marginally higher but with gains limited as on disappointing Australian GDP data. The Nikkei 225 rallied back above the 50k as it was helped by tech-related momentum. The Hang Seng and Shanghai Comp slid after the Chinese tech giants failed to join in the spoils seen in global peers. Composite PMI data continued to show an expansion in activity, but at a slower-than-previous pace.

Gold was steady as it consolidated recent gains after hitting levels last seen in late October on Monday. Central bank buying increased in October, with the strongest monthly add since November 2024.

Chart of the Day – Dow break to upside

The Dow Jones sell-off in mid-November has nearly been erased, after prices hit the minor Fib retracement level (23.6%) of the April to November rally at 45,641. Also adding support was the 100-day SMA, now at 45,929. The bounce back has been solid with cyclicals and healthcare still strong and boosting the Dow, which is less tech weighted. Prices paused for breath in recent days, in another textbook bullish consolidation (flag) pattern. Today’s move to the upside looks to be pushing buyers up to the record top at 48.431. Support below the breakout level could come at the 50-day SMA at 46,824.