Risk assets in the red as Nvidia earnings eyed

* Wall Street slides again as valuation concerns, rate cut jitters linger

* Gold gains on soft economic data, dollar quiet as yields dip

* Bitcoin falls to a 7-month low below $90k before rebounding modestly

* Baidu Q3 revenue falls 7% as ad slump offsets cloud growth

FX: USD was little changed as the dollar didn’t gain anything from its typical safe haven status amid downbeat risk sentiment. The 200-day SMA capped the upside recently, and that comes in currently at 99.99, above a long-term swing low from 2023 at 99.57. A surprise weekly initial jobless claims release saw a pick up to 232k from 219k, though this was from mid-October so stale. Markets await NVDA results and the delayed NFP data. Odds of a 25bps December Fed rate cut has edged higher to 49%. Cautious Fedspeak last week saw this dip to 44%. Soft US data would see this move materially higher.

EUR fell for a third day but price action was muted. There’s very little new news for the euro. The euro does traditionally enjoy positive December seasonality, for what it’s worth. The euro’s technical signals are neutral with an RSI hovering around the 50-threshold.

GBP was flat and mid pack among the majors as it continues to consolidate around 1.3150. CPI is released today. BoE Governor Bailey highlighted inflation developments at the most recent MPC meeting and he is likely to be the deciding vote ahead in December. See more details below on the CPI. Otherwise, there were media reports that Chancellor Reeves is reportedly considering a last-minute raid on banking profits in the budget. This would be a politically favourable move, but perhaps overshadowed by growth-related implications.

JPY was the major underperformer again as USD/JPY pushed up to a high at 155.73. BoJ Governor Ueda and PM Takaichi had their first bilateral meeting on Tuesday, with Ueda highlighting the central bank’s intention to continue with their process of making gradual adjustments to policy. There’s only currently around a 28% chance of December rate hike. Major resistance sits at 157.50.

US stocks: The S&P 500 lost 0.83%, closing at 6,617. The Nasdaq moved lower by 1.2% Mega-cap sectors Consumer Discretionary and Technology underperformed amid continued concerns regarding AI overvaluation. These worries were heightened on Tuesday, as an investment bank downgraded both Amazon and Microsoft, saying it’s time to take a more cautious stance on AI hyperscalers. Health and Energy were the outperformers, with the latter boosted by strength in crude, albeit not on any specific headline driver. US data painted a sluggish picture of the labour market as well, dampening risk sentiment. iPhone 17 models lifted October smartphone sales in China by 37%, giving Apple a 25% market share for the first time since 2022.

stocks: Futures are mixed. Stocks extended losses with indices taking their lead from Wall Street. The ASX 200 saw tech hit hard and a clear defensive bias. The RBA minutes emphasised data dependence and uncertainty. The Nikkei 225 sold off and lost the 49k level, eventually sinking over 3%. China-Japan relations have been strained recently amid yen weakness. The Hang Seng and Shanghai Composite opened in the red with Hong Kong underperforming the mainland.

Gold found a bid through the day having dipped below $4,000 at the start of the European session. The 10-year Treasury yield fell to the 50-day SMA at 4.08% but then bounced.

Day Ahead – UK CPI, FOMC Minutes

Analysts forecast the headline UK inflation rate to ease to 3.5% from 3.8% due to base effects after the Ofgem adjustment. Core CPI is forecast at 3.4%, one-tenth lower than in August. Services inflation should also cool with softer wage growth. BoE December rate cut odds for a 25bps move stand around 80%. There is one more CPI report before that final meeting of 2025.

The FOMC minutes will see markets alert for clues on the Fed’s policy bias following the ‘hawkish’ cut in October, only the second this year. Focus will be on the heavily divided Fed which had one hawkish and one dovish dissenter, and what was deemed a hawkish Powell press conference. He pushed back against expectations for a December rate cut, stressing data dependence amid the shutdown-related dearth of economic data. Markets see a 46% chance of a 25bps December rate cut.

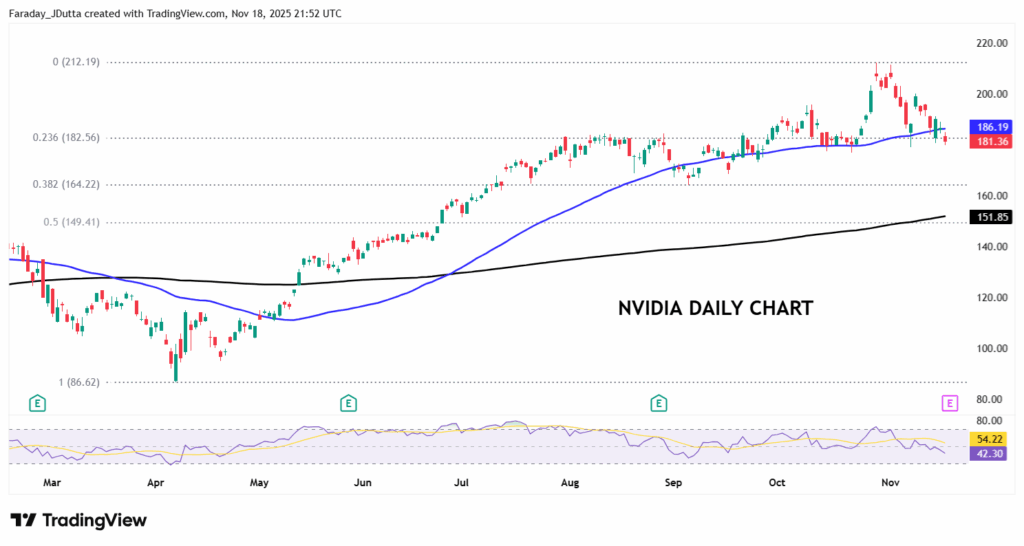

Chart of the Day – Nvidia below 50-day SMA

NVDA is the bellwether and gauge for the stock market (AI) rally. Markets predict NVDA could move 6.5% up or down in the trading session on Thursday, after its earnings release. The stock is up 34% this year. Wall Street analysts expect EPS of $1.23 per share, revenues of $54.7 billion for the quarter and growth rates of 50%++ revenue plus large EPS gains. Investors will be watching any “beat and raise” guidance, especially around next-quarter revenue and shipments of new chips (Blackwell, GB300), and strong demand in the data-centre business, which is the largest driver of growth and margins. Demand from the outside the big four hyperscalers will be a focus. Supply bottlenecks, margins and China exposure will also be analysed, as any signs of risk will matter for investor sentiment. The record high sits at $212.19, the 50-day SMA at $186.24 and a minor Fib of the April to November rally at $182.56. The next retracement (38.2%) is at $164.22.