Weekly Outlook | New Directions After Sideways Price Action

Markets should be expected to offer fresh volatility this week. After the limited momentum during last week’s trading potential new directions might be seen. The Dollar initially geared up some momentum but, in the end, failed to rise. Most currency pairs hence ended the week with Dollar weakness and the trend might now elevate again. Worth noting, though, that the AUD remains subdued and might indicate that the risk sentiment continues to be weak. Stock markets might fall and also cryptos might remain shaky moving forward.

The economic calendar only reveals limited news events this week. Employment data out of Australia and the United Kingdom might move markets while the latter also offers more information with the release of the gross domestic product.

Important events this week:

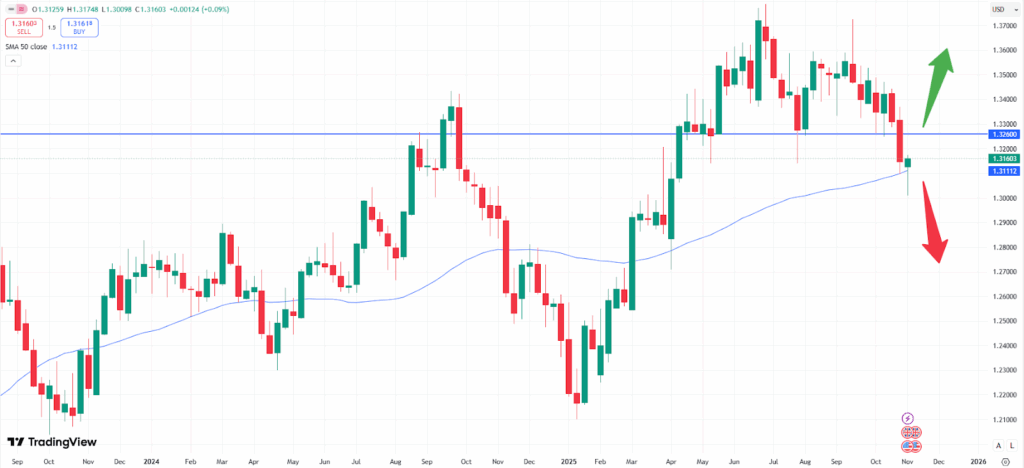

UK gross domestic product: Despite being a backward-looking indicator the Pound might also face fresh volatility with the release of the GDP report. The economy in the UK has been shrinking recently and a decline towards a growth figure of 0.0% on a monthly basis shows the current trend. Last week the Bank of England did not act leaving the interest rate at 4.0% as the pressure of inflation still looms.

Yet, the Pound has been able to defend the recent slide in prices. Based on the weekly chart the GBPUSD currency pair has stabilized right on top of the 50- moving average support zone. A potential positive release of the news might hence help the Pound to rise against other currencies. A potential rise might be found towards the technical resistance zone at 1.3260, where the bearish trend might kick- in again causing the price to potentially fade again further.

US CPI and PPI data: The longest shutdown in US history might soon show negative impact in markets. As important support for the economy as well as the population is absent in parts negative headlines might soon emerge. Stock markets also offer a slight preview here with prices currently falling. Consumer price data as well as producer prices are due to be released on Thursday and Friday respectively but are being likely delayed again.

The NAS100 index shows that the market retraced last week. Traders should now pay attention to the important support zone of 25.200. A clear break of this level might indicate that the market will start to correct further. The market might then try another attempt towards the 24.000 price range.

On the other hand, the market might start to resume upside momentum again at the 25.000 level, as the zone has been tested a few times in recent weeks. If prices stop falling at that level the upside might be resumed as well. Strong momentum might then be found above the level of 26.000. A new all- time- high might then emerge.