Weekly Outlook | Dollar strength and cracks in the bull market

Last week, the Royal Bank of New Zealand cut interest rates to 2.50%. The larger-than-expected rate cut led to a further weakening of the New Zealand dollar, which was an early sign of a possible softening in risk sentiment.

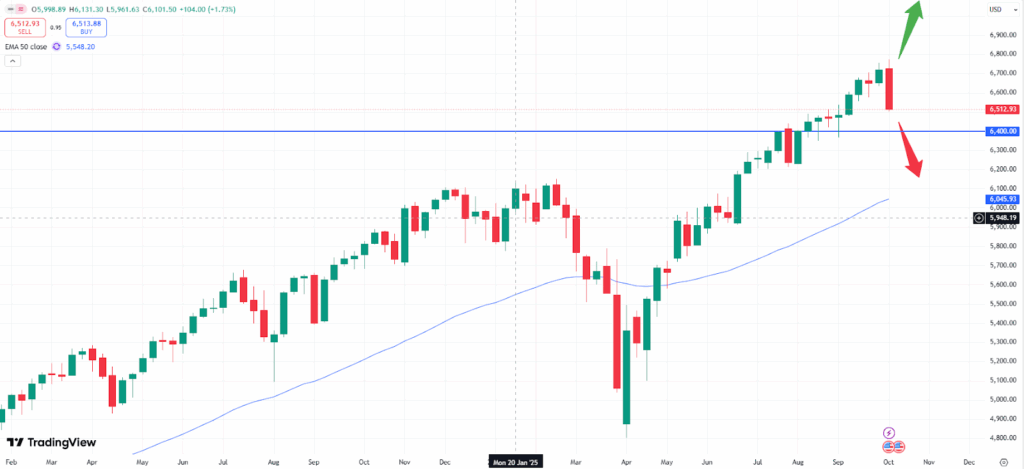

Later in the week, Trump announced new tariffs on China. He indicated that a further 100% could be added. In recent months, the situation had calmed down and financial markets continued to climb from record high to record high.

After the initial introduction of tariffs in April, most stock markets suffered dramatic losses as investors withdrew funds to secure their capital. The situation remains tense at present: the VIX volatility index continues to rise and could cause further headwinds in the coming week. With little data on the calendar this week, markets are likely to focus on this developing issue.

Important events this week:

US producer price index: The producer price index has a strong impact on financial markets. A rise in production prices will also lead to rising prices for the consumer in the end. In particular the addition of new tariffs for goods from China might be significant here. Since prices in particular for consumer goods keep rising, imported products from China might cause a burden for the local economy. The consumer will pay the price after all.

The S&P 500 index might weaken further. As the chart above shows, the current “dent” in the uptrend might cause a bigger slide in markets for now. Yet, nothing much had happened so far. The price had not event gone below the opening price of last month. In general, though, we also pointed out before the usually the month of September has led to falling prices and the current action of the Trump administration might just be the trigger now. The news might furthermore not even be released this week, due to the ongoing shutdown in most parts of the US administration. The tentative date would be Thursday, 16h October.

US retail sales: Complementing the above data also the retail sales data will be important. Whether the news will follow this week can’t be determined due to the aforementioned shutdown in the US. It is expected that the data will decline.

The AUDUSD currency pair shows a strong correction to the downside amid fresh strength of the greenback. The AUDUSD currency pair is also meant to show the general risk sentiment in markets. A rising pair indicates that investors and traders are expected to buy stocks and other riskier assets like cryptos while a falling trend might indicate that stock markets might fall.

The current break of the 50- moving average might offer more negative pressure. A break of the strong support zone at 0.6415 could also signal another slide lower. If the news is published or the zones mentioned are tested, this could provide new insights into the direction of the currency pair. The tentative date of the release is Thursday, 16th October as well.