Dollar bid, stocks sold amid ongoing government shutdown

* Yen traders caught in ‘mass square-up’ following Takaichi win

* S&P 500 sees first drop in eight days on Oracle slide, shutdown angst

* Furloughed US Federal workers may not receive back pay

* Gold nears the psychological $4,000 level, boosted by ETF demand

FX: USD pushed higher for a second straight day helped by more weakness in the yen. The Index moved up to the medium-term downward trendline from the May peak. The late September top sits at 98.60. The government shutdown continued with the latest betting probabilities marginally lowering their expectations (to 69%) of this closure ending on October 15 or later. The day saw multiple Fed speakers. Governor Miran continues to have a sanguine outlook on inflation, while 2026 voter Kashkari cautioned on any tariffs impact on inflation.

EUR sold off amid the French political chaos and closed below the 50-day SMA at 1.1687. Fresh elections of some type (legislative or even Presidential) look increasingly likely, especially if opposition parties don’t approve of any new PM. But this very probably won’t solve the fiscal situation and the dire French debt mountain. We are watching French: German bond spreads as the best signal for stress and markets then selling the euro more aggressively. A decisive break of 1.1655/45 could see more downside relatively quickly.

GBP dipped to 1.3392 before paring losses. A lack of top tier data has meant more focus on the November Budget. Bloomberg reported that Chancellor Reeves is set to receive an unexpected £5bn boost to her budget plans from inflation. The gain offsets higher debt servicing costs, helping narrow the UK’s projected £20-30bn budget shortfall ahead of the budget.

JPY was sold again, losing another 1% after the 2% loss yesterday. Prices closed above the July/August tops at 150.84/91. A major Fib level (61.8%) of the January to May drop sits at 151.67. The ‘Takaichi trade’ is still in effect with a steeper yield curve, strong stocks and a weak yen. This comes on the assumption that heavy fiscal stimulus is on its way, and fewer, if not a reversal, of rate hikes. Odds of an October one has now dwindled to below 20%. We note President Trump is visiting Japan soon and will not like the recent yen weakness.

AUD struggled along with the NZD at the bottom of the major’s board. Weak consumer sentiment data in the former didn’t help the mood, along with subdued equity performance. CAD outperformed closing more or less flat versus the dollar. The 200-day SMA looms above at 1.3977. Amid broader uncertainty in France and Japan, close economic ties to the US typically can help the loonie.

US stocks: The S&P 500 lost 0.38% to close at 6,715, ending the seven day win streak. The Nasdaq moved lower by 0.55% to settle at 24,840. The Dow Jones finished at 46,603, down 0.2%. Consumer Discretionary and Communication Services led the losers with Consumer Staples and Utilities the leading sectors. Media reports showed the financial challenge of renting out Nvidia chips and its impact on profits, which result in razor-thin gross margins. This hit the large-cap tech sectors while Oracle also sold off aggressively. Tesla slid 4.5% after it unveiled a more affordable version of its Model Y, which disappointed investors who had hoped for an entirely new vehicle. The move was seen as a chance to revive demand after the end of the $7,500 federal EV tax credit at the end of last month.

Asian stocks: Futures are mixed. Stocks traded mixed amid regional holiday closures and in spite of the tech-led gains Stateside. The ASX 200 was muted with losses in Tech, Telecoms and Consumer Discretionary. The Nikkei 225 printed more all-time highs amid the tailwinds of the incoming Takaichi government. That kept cyclicals bid on the pro-growth agenda soon to come. The Hang Seng and Shanghai Comp were closed for holidays.

Gold rallied once again to a new record at $3,991, with ETF demand continuing to spark comments about ‘FOMO’ in this modern-era gold rush. The ‘debasement trade’ is also increasingly being cited as a factor in this incredible bull run, with waning faith in fiat currencies in the face of persistent government deficits and inflation.

Day Ahead – RBNZ Meeting, FOMC Minutes

The RBNZ is expected to cut rates by at least 25bps, which would lower the OCR to 2.75%. But markets see around a 56% chance of a bigger, half-point move. The June GDP print of -0.9% was way below the MPC’s forecast of -0.3%. That leaves a bigger than expected negative output gap. There has also been a change in the MPC composition with the departure of the most hawkish member possibly shifting the balance toward bolder easing. The bias is fully expected to remain dovish, with scope to move again if officials opt for a smaller cut. There is the risk of overshooting late in the easing cycle with one big cut this time.

We get to hear if Fed Chair Powell and his caution around more rate cuts is a view shared by the majority at the central bank. The Fed cut rates by 25bps to 4.00-4.25% at its most recent meeting, as expected. The median dot plot signalled two more rate cuts this year though the committee was split fairly evenly with nine predicting only one more this year. Growth and inflation projections were raised for 2026 with focus on downside employment risks.

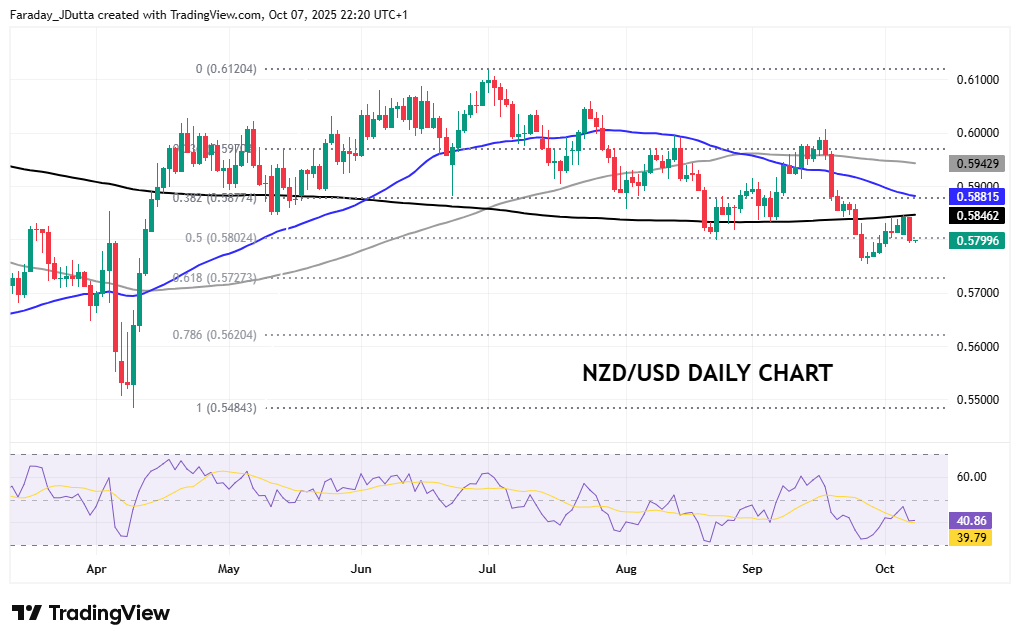

Chart of the Day – NZD/USD under pressure

The kiwi has struggled over the last few weeks with the RBNZ openly dovish. If not 50bps today, then at least another 25bps rate cut at its next meeting seems to be the order of the day. Any clues on policy and if the central bank will continue to lower rates to below its previously projected trough of around 2.50% will be key. The major has fallen quite sharply from the September high at 0.5991 and after a brief bounce, remains below the 200-day SMA at 0.5846. The midpoint of the April low to start of July top sits at 0.5802. Below here is the September five-month low at 0.5754.